Talking Climate Tech 028

💸 Global Energy Investment | 👥 Community Energy | 🇬🇧 Spending Review | 🖤 Trump v Elon | 🌪️ Methane | ⚡ Pylon of the Month

After dipping our toe in minewater geothermal 🔦 Spotlight Feature the last couple of weeks, 💸 Startup News is passed over as I look for the next category, or someone flags a request - instead, I have some interesting Global Energy Investment data for you.

The bee and the pollen? All was revealed in the personal note to subscribers. 😉

💸 Investment News

The IEA has released some global energy investment trends, via its World Energy Investment Report 2025, and despite the geopolitical headwinds, it makes for positive reading. Here we go:

Global investment is expected to rise by 2% to $3.3 trillion this year. China is by far the largest single investor in energy, spending almost as much as the United States and the European Union combined.

Why it matters - Despite all the noise around China's coal build-out, its pace of electrification and renewable energy generation is leaving the rest of the world in its wake. In around 10-15 years, they will be calling out the West and have a much cleaner, low-cost, electric-oriented economy to benchmark us against. ⚡

Around $2.2 trillion is going collectively to renewables, nuclear, grids, storage, low-emissions fuels, efficiency and electrification – twice as much as the $1.1 trillion going to oil, natural gas and coal.

Why it matters - Unpicking economies from reliance on fossil fuels is gradually happening. Transitioning industrial policy and a renewed focus on energy security due to geopolitical concerns is helping drive that change. When energy security goes hand-in-hand with the cost competitiveness of electrified solutions, the decision-making process accelerates. The emissions and health benefits, our original and logical primary focus, are becoming secondary drivers to economics and security. Whatever it takes. 📈

A new Age of Electricity is drawing nearer. A decade ago, investments in fossil fuel supply were 30% higher than those in electricity generation, grids and storage. This year, electricity investments are set to be some 50% higher than the total amount being spent on bringing oil, natural gas and coal to market. However, investment in grids, now at $400 billion per year, is failing to keep pace with spending on generation and electrification.

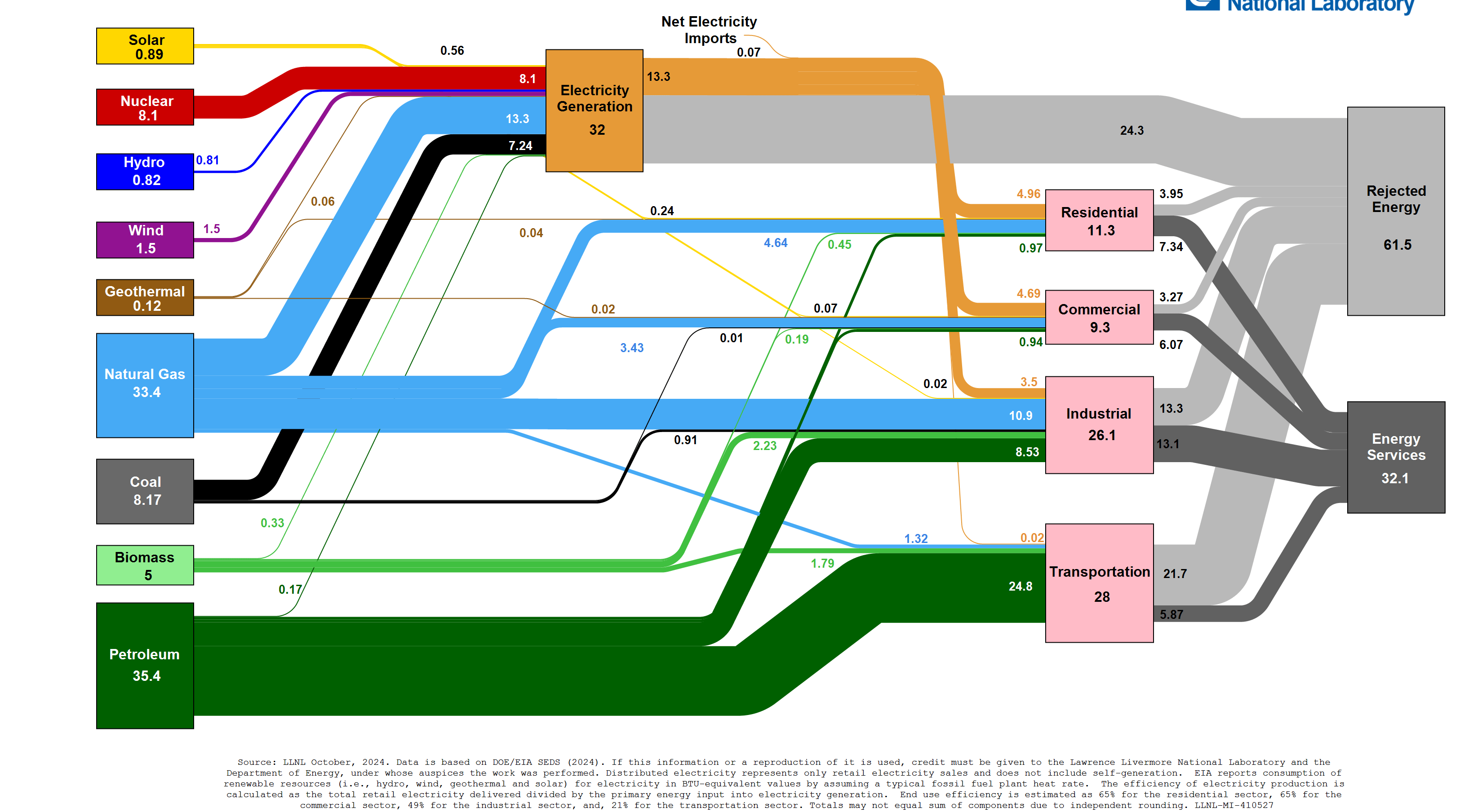

Why it matters - The shift has happened, and now the great grid challenge remains to level up with the implementation of renewable generation assets. A decentralised, distributed model will have a big impact. As we utilise a wider range of assets, such as BEV energy storage with V2G, behind the meter solar [See Pakistan's solar boom], more waste heating & cooling / less grid demand, and the primary energy fallacy kicks in [2/3rds of all global fossil fuel energy is rejected - see below. ⚡

We will need a lot more grid build-out, but perhaps not as much as first anticipated. HVDC cables that enable an interconnected, multi-national grid infrastructure mean we can share and manage electrons more efficiently. There are approximately 200GW of HVDC in current use, covering 58,000km, with 180GW in project development and planning, covering 45,000km. 🔗

Globally, spending on low-emission power generation has almost doubled over the past five years, led by Solar PV. Investment in solar is expected to reach $450 billion in 2025, making it the single largest item in the global energy investment inventory.

Why it matters - that Solar cost reduction is incredible and has enabled an energy for all rush - reference the domestic application behind the meter in Pakistan linked above. Yes, grid-scale solar, wind, and battery will be doing most of the heavy-lifting, but Solar will be the key to unlocking a democratic, just transition, bringing electricity to those who don't currently have any.... ⬇️

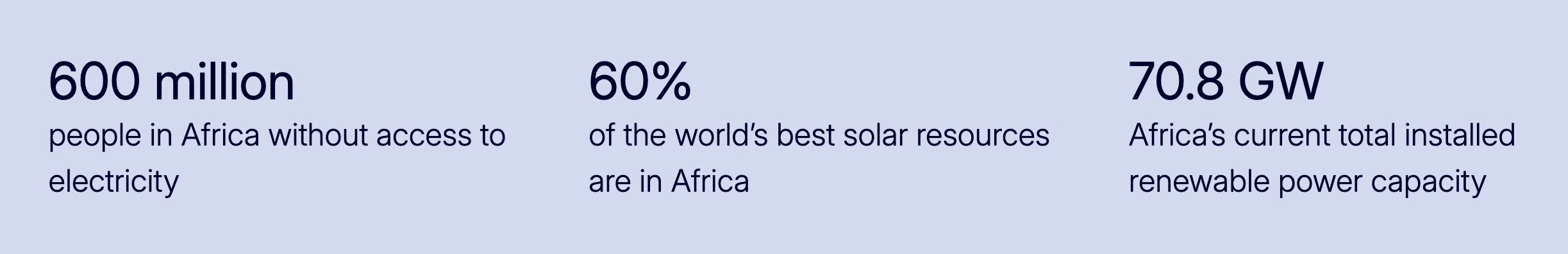

Spending patterns remain very uneven globally. For example, Africa accounts for just 2% of global clean energy investment today, despite being home to 20% of the world’s population.

Why it matters - it's a global transition, we need to take everyone along on the journey. We aren't doing enough to transition countries and regions that are inhibited by legacy debt to developed nations, tied to fossil generation and poor grid infrastructure.

Good things are happening, such as the Mission 300 [bringing electricity to 300 million people in Africa for the first time by 2030]. For a sense check, 600 million Africans remain without access to power, 83% of the global unelectrified population. And the UK has approx. 57.5GW.

Further reading on the EU Commission's input into the 'Scaling Up Renewables in Africa' campaign, here. 🌍

🔎 Deeper Dive

Community Energy 👥

I've been on a bit of a community energy vibe this last week. Discussing various calls, the potential, problems and pitfalls for community energy projects, new tools for wind energy projects to shortcut the planning process, the role of geothermal energy for heat and heat networks in general - all sorts!

I was thinking about all that again, triggered by the Ripple Energy article, and failure. But equally inspired by Project Collete, a 1.2GW offshore wind project - showing community energy can also aim to achieve aspirational and projects:

Project Collette (as in collective) aims to be 1.2GW (80-100 turbines) offshore wind farm off the Cumbrian coast – large enough to power about 1 million homes a year. As to emissions reduction, the electricity generated will save around 1,000,000 tonnes of CO2 a year

More to follow on Community Energy in the future. In the meantime, a couple of LinkedIn posts from me last week:

Community Heat Networks - Extending Southampton DESNZ zoning

Community Energy Projects - Instigating Change - The South Vacuum

UK Spending Review 💰

It was the week of the update, who were the winners, who held onto some cash, and what else happened. Scores ready!

Nuclear got a boost - £14.2bn for Sizewell C, to get them started. Which is supposed to be a cheaper copy & paste of Hinckley C. Chances of that playing out as planned are quite slim. Hinckley C is at £46bn, and rising, budget £18bn and estimated to be at least 5 years late around 2031.

Nice if you can get it, and afford it, and can wait 10-15 years. Great that they are 3.2 GW each, although in reality, they will just be replacing what we have already shut down or are planned for end-of-life in the early 2030s. More on all that here.

There was also the not insignificant sum of £13.9bn for the Nuclear Decommissioning Authority 🤯 ☢️

Oh, and £2.5bn on nuclear fusion! 🎲 🎲 🙄

Score 🟠

Warm Homes Scheme - held its ground with £13.2bn allocated across the 5-year period. Further reading here, Nesta takes a look at what could be done with the extra £1.3bn per year - they have doubled the previous Gov. commitment. Exptec it to benefit around 30% of the national housing stock, social housing, low-income homes, more BUS and retrofit loan options. ♨️

Score 🟢

GB Energy - held its promised £8.3bn, although it now has to juggle and share £2.5bn of that with GB Energy - Nuclear, to cover off the commitment to Rolls-Royce SMR.

We can expect x3 SMR's by mid-2030s at 300 MWe per unit after the run-off against the US and other competitive bids.

Also, a couple of extra interesting lines in this one, as the GBE mandate is still rather unclear. It's now designated as a PFI, similar to the National Wealth Fund:

additional financial transactions, such as loans and equity investments, to support growth...[explains, to:] allow government to invest alongside the private sector, through equity investments, loans and guarantees

Notes in there include £300m for offshore wind supply chain, and £80m for port infrastructure upgrades to support FOW in Port Talbot.

Score 🟢

CCS - still got some money, quite a chunk at £21.7bn over 25 years, despite CCS being labelled 'high risk' by the Public Accounts Committee. More on Viking in the Humber Cluster, and Acorn, in Scotland. ⚫

As with most CCS, expect missed targets, ballooning costs and business as usual for those involved, as it's the taxpayer on the hook. 😮💨

Score 🔴

Transport - quite a few different tranches in here, which does include a big lump for HS2, although declining for the period to £25.3bn! 🚄

Most notably - 4% real-terms increase per year through to 2030, on capital projects for regional rail improvements, mainly in the North, at £10.2bn, which will take significant CO2 off congested roads.

At least they got some much-needed funding to improve Northern regional rail networks. ✅

There is some on EV, decarbonising transport, charging infrastructure, and SAF at around £5bn total, which doesn't seem much by comparison. 🤔

Score 🟠

Floods & Farming - these unfortunate bedfellows are critical to our food security and resilience. Clarkson's Farm Season 4, Amazon TV, is a good watch if you want to see the impact of floods on crop yields.

increase the UK’s resilience to the effects of climate change and protect the ecosystems that underpin the economy and food security

£2.7bn in sustainable farming and nature recovery, £4.2bn to build and maintain flood defences, farmers will benefit from £2.3bn from ther Farming & Countryside Programme, and rising to £2bn on nature-friendly farming support.

Good progress on this one. Not sure on drought impact, more reservoirs and water infrastructure, all of which are so closely integrated into the wider system. Water companies have it all in planning for 2050 apparently 🤔 I suspect Thames don't! More info.

Score 🟢

Overall Scorecard

Trump Watch 💥

I had to check back into 027 to see what had happened last time in the US soaps to end all soaps. As always, a lot happens in a week over in Trump-town.

Elon and Donald had fallen out, their relationship in tatters. 😭

They did step back from the initial volley of hissing and slapping, SKY News reports:

Mr Musk said: "I regret some of my posts about President @realDonaldTrump last week. They went too far."

In response, the president is quoted as telling the New York Post: "I thought it was very nice that he did that."

While they were messing about, there was Ukraine-Russia, Israel-Gaza, and now Israel-Iran to contend with. He's forgotten about all those - too complicated, too much time, didn't happen in 24 hours. 🙄

People Power 👏

There was also California vs the US National Guard and Marines. Legal battles are underway in that one. More here.

Elsewhere in the US, it was the gas-guzzling $45m Trump Military Parade on my birthday vs #NoKings protests around the country.

We know Don loves to boast about the size of his crowds - oh dear, by all accounts, it was Parade significantly less than the planned 250,000.

More on the organisational farce here. 🤣

#NoKings at 5 million across 2,100 rallies! More here.

EU Methane Arm Twister 🌪️

As always with Don, while you are watching the show, it's behind the curtain where the action is.

What's the dodgy hand up his sleeve - US LNG exports of course! From WeDon'tHaveTime:

...the EU would need to buy $350 billion in U.S. energy to eliminate the trade deficit, with a deadline of July 9 to reach a deal to avoid tariffs. Since Russia invaded Ukraine, the EU has been trying to limit its usage of Russian gas and now buys 45% of its liquefied natural gas (LNG) from the US.

Methane is the second-largest driver of climate change after CO2. Over 20 years, it warms the atmosphere 80 times more than the same amount of CO2, but it only stays in the atmosphere for about 12 years. Limiting methane emissions can slow the climate crisis

$350bn, that's quite a commitment. His pals must be feeling well pleased! Not quite as easy as it sounds. There are some regulatory hurdles to overcome.

The EU’s 2024 methane regulations require oil and gas importers to monitor, report, and reduce methane emissions throughout the supply chain. It is possible, the technology exists - the US LNG sector is rather laissez-faire when it comes to regulations, emissions and monitoring.

And its not just upstream, more on the emissions from LNG shipping here from Inside Climate News - hint, its MASSIVE:

total greenhouse gas emissions more than quadrupled from about 4.1 million metric tons of CO2 equivalent for 224 return journeys in 2017-2018 to around 18.4 million tons for 1,265 journeys in 2023-2024. To put the latter figure in perspective: It equals the annual greenhouse gas reductions from swapping 5.8 million gasoline-powered vehicles with an equal number of electric vehicles

Trump is trying to twist the EU's arm to reduce those regulations to enable US LNG to flood into the EU in his mega-deal. Rather than upgrade the US to EU standards, they would rather remove the methane standards from the IRA implemented in 2022.

The EU’s current methane regulation could reduce methane emissions from oil and gas imports to the EU by at least 64% by 2031. It’s already influencing global standards — several US LNG producers have already committed to align their production with the EU’s requirements. Other countries are implementing similar methane intensity standards, including Japan and South Korea, which would put US LNG companies at a disadvantage.

More on the backstory of US LNG here from Justin Mikulka of Oilfield Witness.

Let's hope, for many reasons, the EU holds the line on this one.

Farewell, Atlantic Shores 🪁

We talked about Empire Wind getting canned and then reinstated in previous weeks. Next up, due to 'headwinds' from Trump, including with withdrawal of granted permits, EDF and Shell have canned this one.

1.5GW of clean wind power - thousands of jobs, steelwork, supply chain, etc. More here.

🏡 Konfab News

Ripple Effect 🧐

You might have seen or heard the news in April that Ripple Energy, a UK-based community wind and solar project originator and project manager, unfortunately, went into administration.

A disappointing blow for community energy in the UK - they had already developed x4 multi-MW wind and solar projects, and were heading towards energising a new Solar project and had a new onshore wind project in early stages.

Ripple enabled anyone to invest and buy a share in a project, to get discounted electricity bills. Great for people who couldn't afford the investment in, or access to, solar or heat pumps. Doubly disappointing for me, as I was one of those people with a small investment!

The stages of updates, dealmaking and continuation, post administration, are rather murky; I was asked for comment recently in this article for Currents:

Video Podcast 🎙️

We just wrapped up recording Episode 06, on Thursday - thermal energy storage, key UK scale-up! Expect a flurry of releases in the next few weeks!

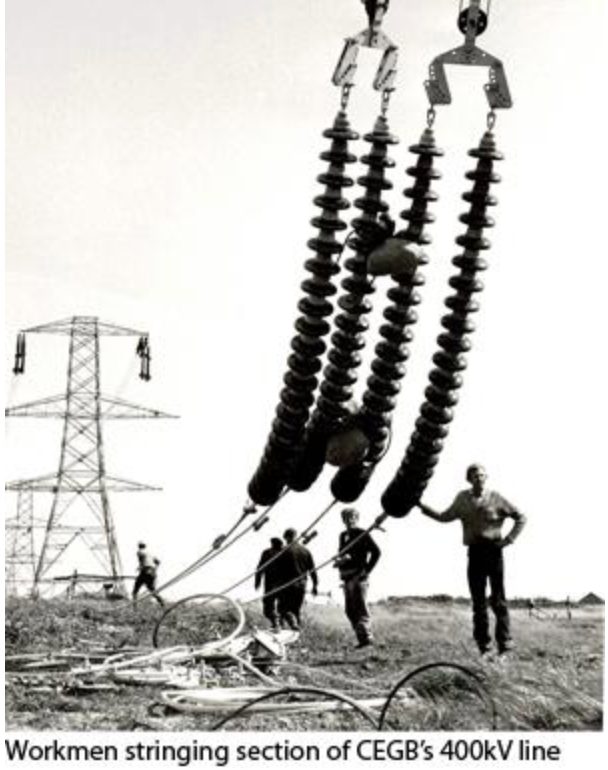

Pylon of the Month ⚡

Bringing you some Tower of Power insights this week from National Grid as we wait for more news from Pylon HQ - or any submissions from the Talking Climate Tech subscriber fan-base!

- The word pylon comes from the Greek word 'pyle' for 'gateway'

- The UK's first electricity pylon was built in Scotland in 1928

- There are approx. 22,000 pylons, 4,500 mile of lines, in England and Wales

- The tallest electricity pylons in the UK, River Thames, 190m

- The world’s tallest pylon, China, 380m

Image Credit: National Grid

On that bombshell...

Thanks as always, let's keep pushing forward - remember, the momentum is unstoppable despite everything you might see and hear! 🌍

Stay warm, cool, dry, wet and safe wherever you are 🙏

Kane