Future Fuels Onboard for Maritime Decarbonisation?

Ammonia or Methanol - what are the challenges and chances of them being the solution?

Introduction

I recently reviewed Kane's article from the Maritime UK Solent Conference, at which there was a lot of discussion about 'future fuels' and how to decarbonise the shipping sector.

It's considered one of the hard-to-abate sectors - shipping represents 3% of global emissions, and is expected the rise to 10% by 20250. Transport&Environment.

Some interesting data and wider context in the article here:

Unfortunately, there is no magic answer for global shipping. The use of bunker fuels, typically conventional heavy fuel oil (HFO) and marine gas oil (MGO), is utilised in huge volumes - global maritime consumes over 210 Mt of fossil fuels a year. 🤯

To replace this volume of fossil fuel is impossible, for now, with clean fuels and battery systems. Developments are rapid, however, massive new battery freight services are opening up domestically in China, so they are on the future roadmap for short, inland and inshore freight. Insights from Electrek:

COSCO Shipping says the Green Water 01 electric container ship presents multiple firsts for the marine industry, including total length, width, container capacity, deadweight tonnage (10,0000 tons), and battery capacity (50,000+ kWh).

...the number of battery modules can be configured depending on the length of the voyage at sea...additional 20-foot battery boxes offering 1,600 kWh of electricity can be loaded onto the container for extra range...equipped with 24 battery boxes, the ship can complete trips that consume 80,000 kWh of energy, equivalent to approximately 15 tons of fuel and can save 3,900 kg (8,600 pounds) of fuel for every 100 nautical miles travelled, cutting carbon dioxide emissions by 12.4 tons.

We are some time away from transatlantic electrified shipping, if ever. In the meantime, the race is on with adaptation and efficiency measures, such as slow-steaming, hull performance optimisation, onshore power supply systems, etc.

E-fuels such as LNG, Ammonia and Methanol are proclaimed as the alternative future fuels. LNG has been the dominant procurement winner for new vessel orders in the last few years. Further data in Kane's article.

However, more recently, the new IMO Global Fuel Standards and Emission Pricing regulations have made LNG a less obvious choice with heavier penalties.

Let's look at a couple of the other future fuel options - Ammonia and Methanol.

Ammonia

(NH3) has been proposed as a shipping fuel, but its potentially harmful side effects are likely significantly underestimated.

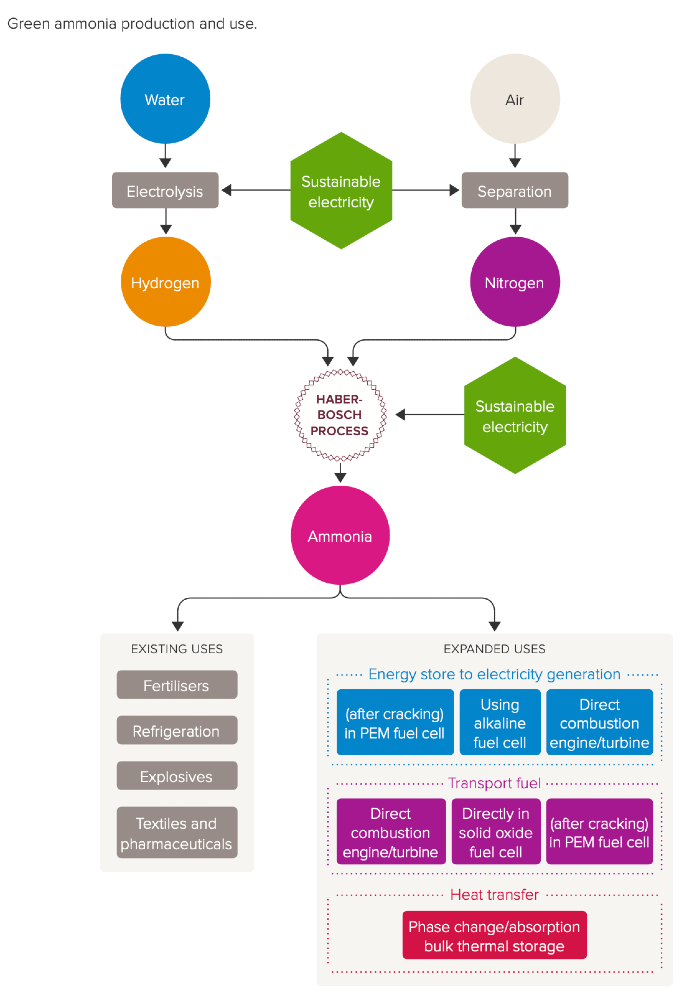

The global production of NH3 is 190 Mt annually, the vast majority is produced from fossil fuels (72% CH4, 26% coal, 1% oil) - a fractional amount is green NH3. The majority of NH3 is used to produce fertilisers (80%), nitric acid, explosives, plastics, and refrigerants.

Production of NH3 is linked to 1.8% of global fossil CO2 emissions - it's a huge opportunity for decarbonisation itself, particularly for global agriculture, before even being considered for shipping fuel. Royal Society paper:

Agricultural fertilisers account for 80% of annual ammonia production, but only 17% of that nitrogen is consumed by humans in crops, dairy and meat products. The remainder leaches into the soil, air and water, causing widespread biodiversity losses, eutrophication, and air quality issues from particulate matter, emissions of greenhouse gases and stratospheric ozone loss.

NH3 is a colourless irritant gas with a strong odour - it is also severely toxic.

Exposure to high concentrations of NH3 in the air causes immediate burning of the eyes, nose, throat, and respiratory tract and can result in blindness, lung damage, or death. ☠️

Liquid NH3 has a 2.73 x lower gravimetric energy density compared to bunker oil, which means that the annual production of NH3 would cover only 30% of the annual consumption of the global maritime potential demand.

NH3 combustion produces emissions of NOx and unburned NH3 in the exhaust. NOx is composed of the thermal NOx and the fuel NOx, which is the major pollution of NH3 combustion.

NH3 has very poor combustion characteristics, including high auto-ignition temperature and low flame speed. That is why it needs combustion triggers like diesel, hydrogen, dimethyl, etc., with an application ratio ranging between 40% to 95%. This is not a clean-burning fuel. 🔥

In a recent study, the performance of a GDI single-cylinder engine fueled with gaseous NH3 achieved an efficiency of only 36%.

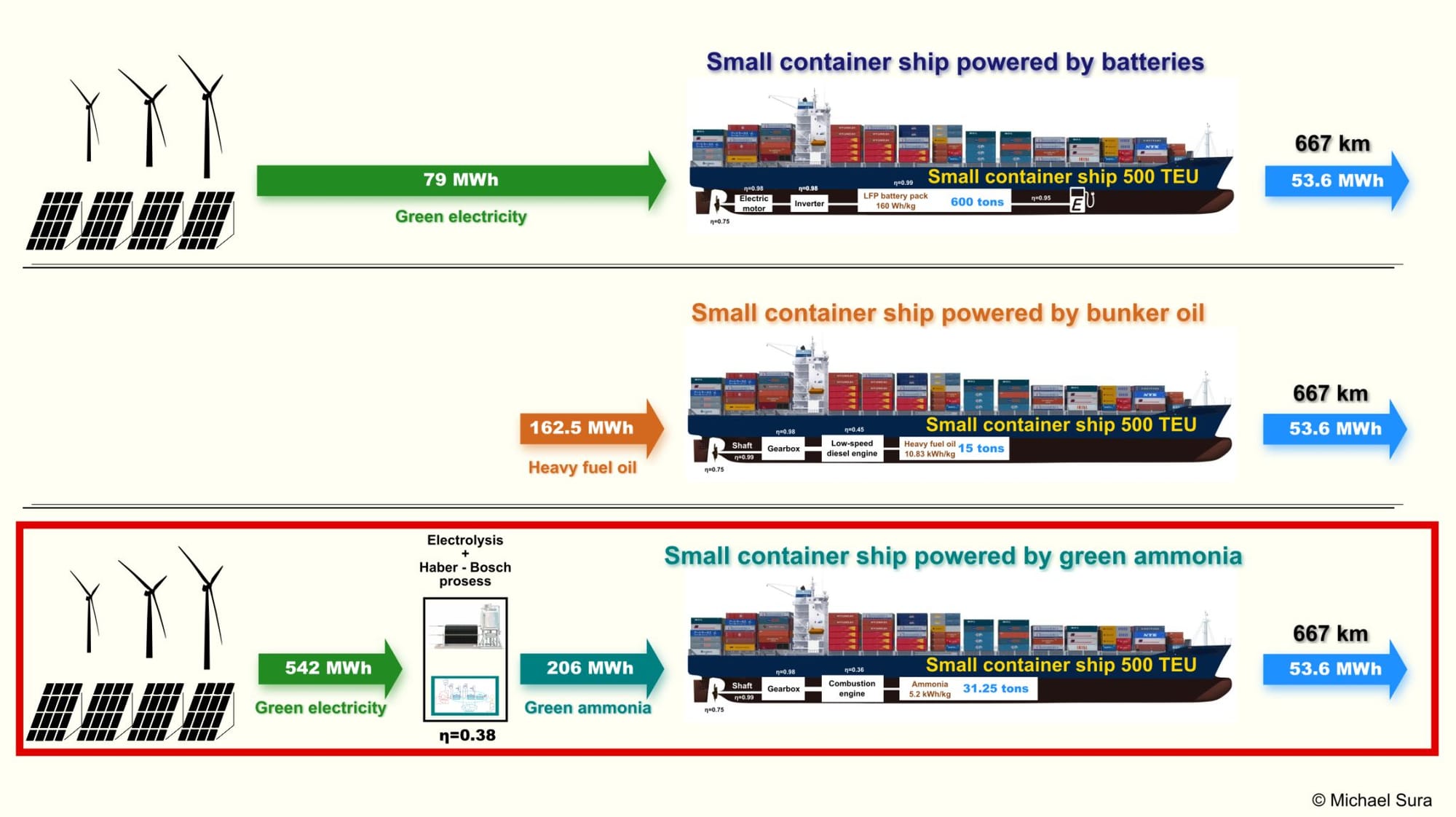

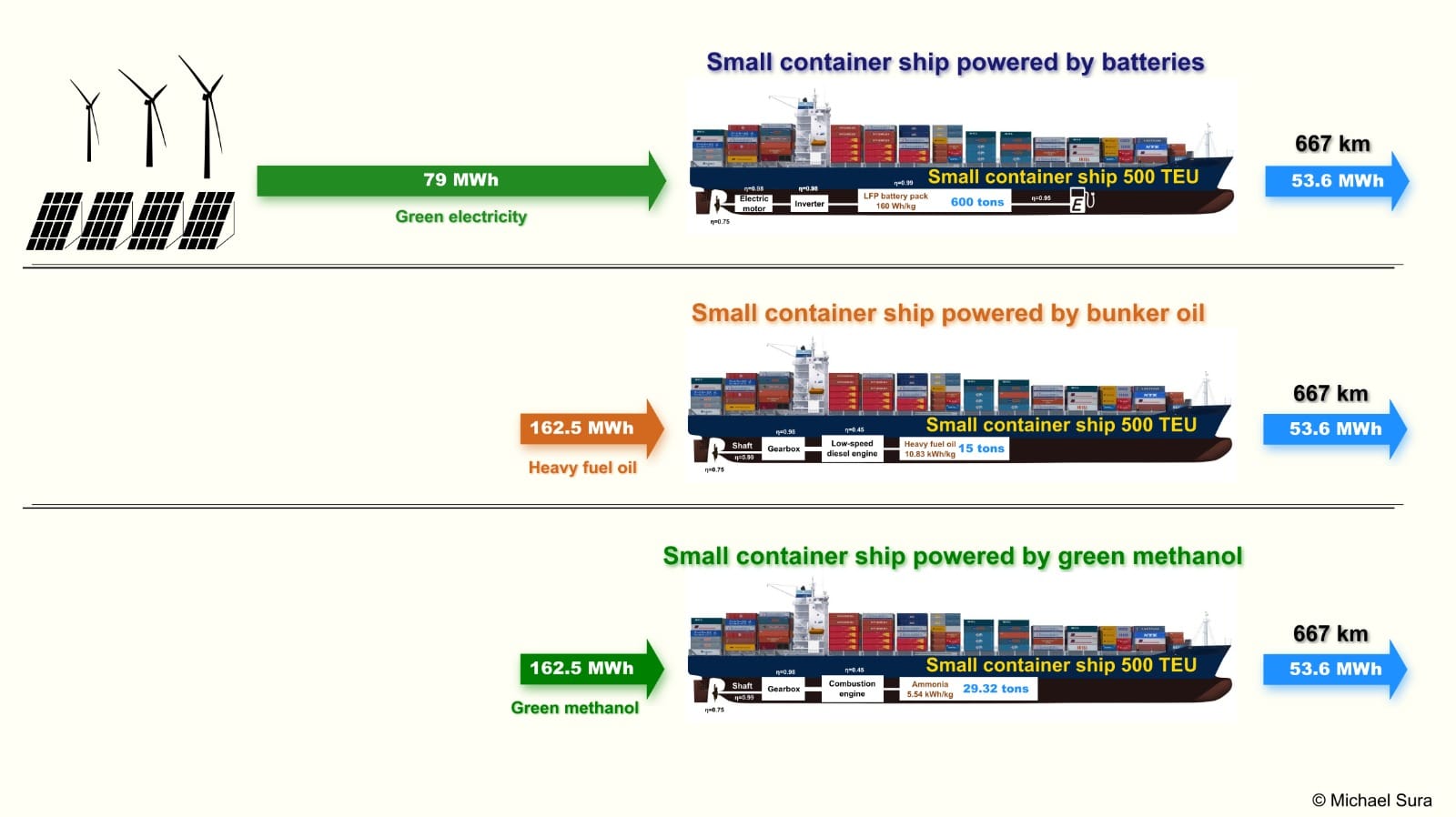

For my example, I used an engine with this efficiency to drive a ship powered by green NH3, and I compared it with the energy consumption of a ship powered by bunker oil and electricity from a battery from a previous calculation I had made.

Despite almost 500 tons of batteries, this battery-powered ship would cover a distance of only 667 km. Utilising an LFP battery pack with the specific gravimetric energy density of 160 Wh/kg (CATL CTP 3) Qilin, it would weigh approximately. 493.75 tons and its price would be $8 mil. USD - but it makes for an interesting comparison.

The well-to-wake efficiency of a green NH3-powered ship is less than 10%. You will receive 53.6 MWh of mechanical energy that moves the ship for the specified distance, from 542 MWh of green energy input.

NH3 as a ship fuel is a very toxic and dangerous square propeller - an NH3 leak represents a very real risk to the lives of the ship's crew to save some money (if any) in fuel costs. ☠️

Methanol

Maersk has secured green methanol fuel for new vessels. The ships are scheduled for delivery from 2024 to 2025. They introduced the world's first container cargo ship powered entirely with biomethanol in late 2023. Maersk:

Methanol is a liquid at ambient temperature and pressure, making it a favourable marine fuel in terms of storage and handling. Dual-fuel two- and four-stroke methanol engines are commercially available and operational. The industry has also gained operational experience of these engines on board different ship types in the past decade. Methanol dual-fuel engines are now being developed and commercialised for a wide range of vessels.

In 2023 Maersk launched the first methanol dual-fuel container vessel, Laura Maersk, which has undertaken several voyages on green methanol. By 2024, over 100 dual-fuel methanol new builds have been contracted with yards, and many projects for methanol dual-fuel retrofits have been announced.

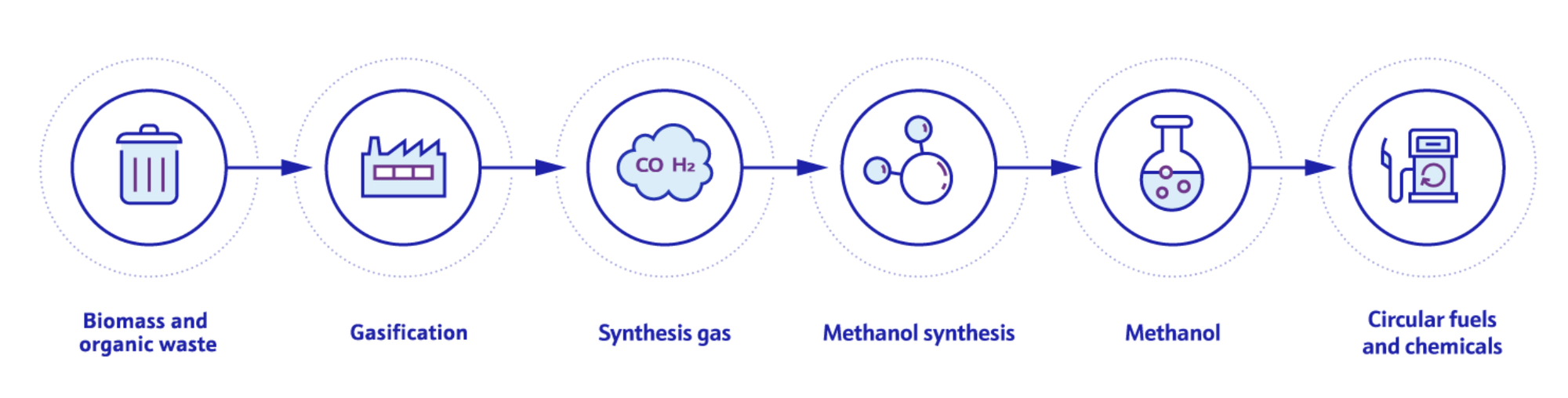

More on the biomethanol process from Johnson Matthey:

Biomethanol is a renewable alternative to fossil-based methanol, produced from sustainable feedstocks such as waste streams. By converting organic waste into syngas through gasification, this process enables the production of low-carbon biomethanol.

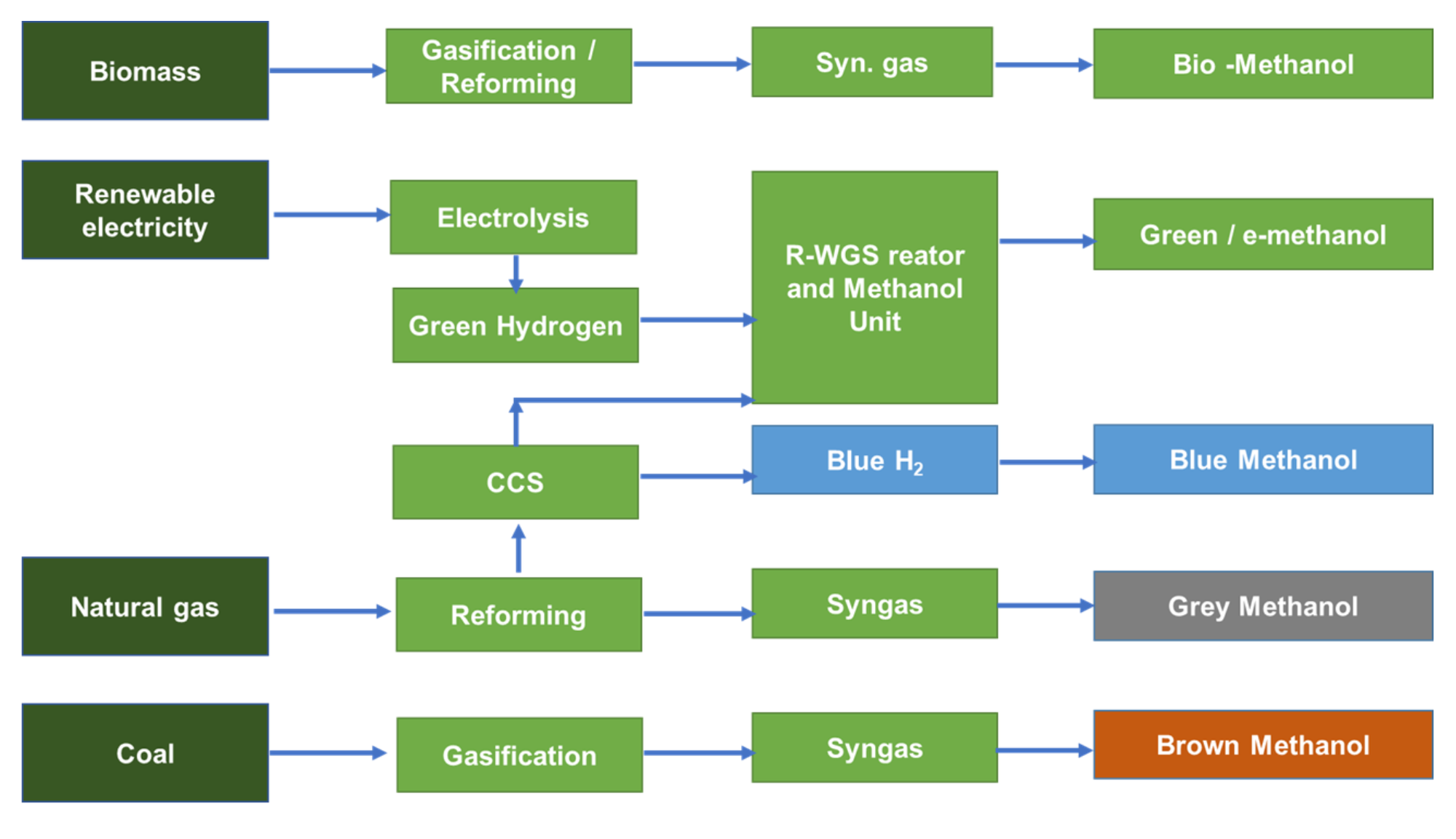

As you might expect, just like Hydrogen, not all Methanol is made equal and beneficial in reducing emissions when used as a fuel. This brings about investment, production, off-take and cost challenges - a complex topic, for another article.

Methanol has its risks, but they have been well known and understood for decades in the chemical processing industry, and can be managed effectively and safely. In comparison to Ammonia, the risk in confined spaces for shopping applications is vastly reduced. Further reading here.

Sounds reasonably positive so far - is the use of bio-methanol primarily, and potentially green methanol, a scalable and sustainable way to decarbonise maritime shipping? 🤔

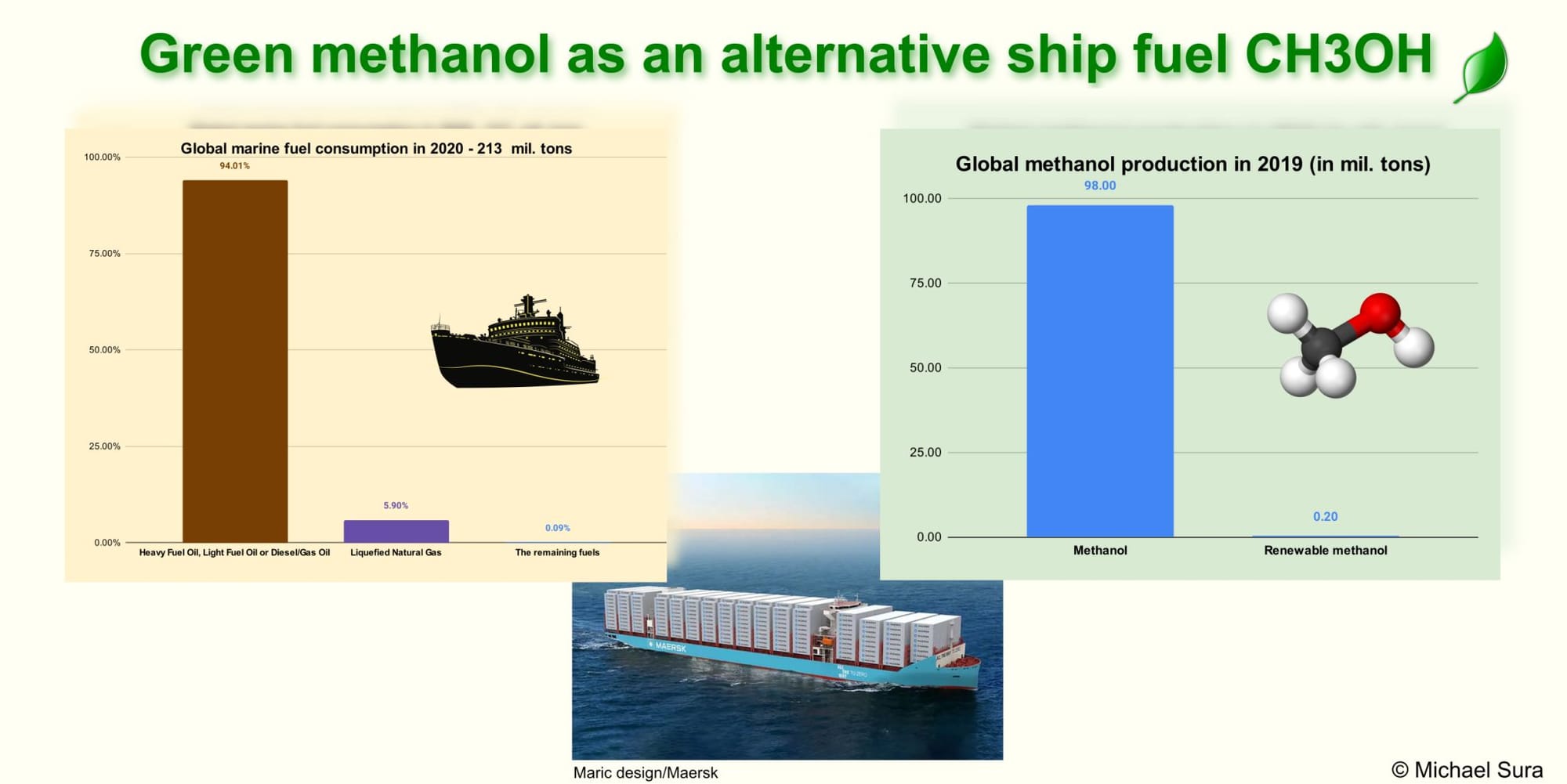

According to the 2019-20 Marine Environment Protection Committee (MEPC) in total, the shipping industry consumed 203 Mt of fuel in 2020. Fuel oil accounted for 94.01% of maritime fuel consumption, and the share of LNG was 5.90% of the reported fuel in 2020.

The share of the rest fuel types (Used Cooking Oil, Biofuel, Biogas Refrigerated Liquid, etc.) amounted only to 0.09% of the fuel used during the 2020 reporting period!

According to industry analysts, the worldwide annual production of methanol reached an estimated 79.2 Mt in 2024.

The vast majority, 99.8%, was produced from fossil fuels - it's a highly versatile and in-demand chemical widely used for the production of everyday products, including plastics, paints, car parts, and construction materials. ⚫

Production of renewable methanol is approximately 0.2 Mt annually currently. 😮💨

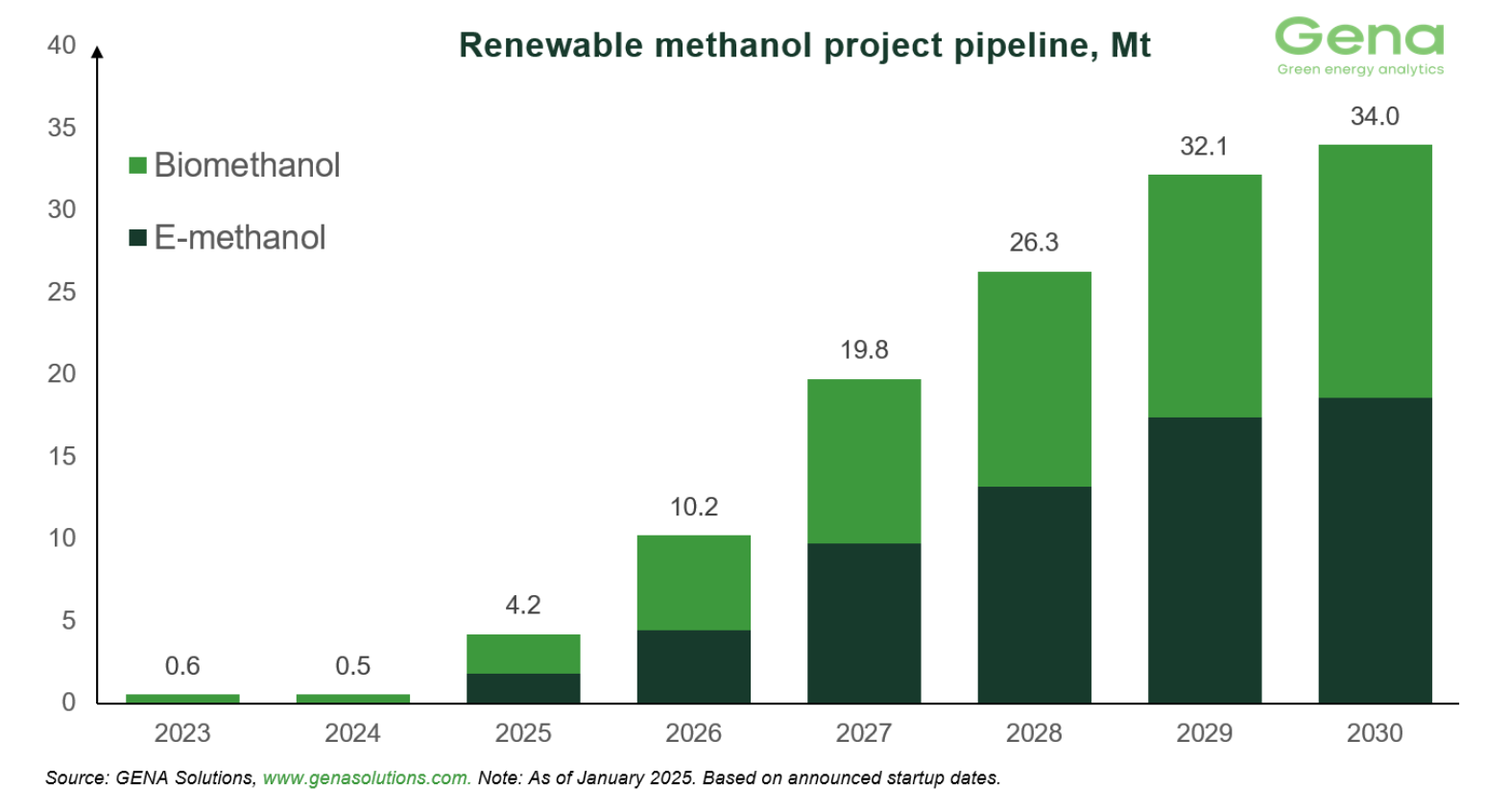

There is a significant project pipeline building, further reading here from GENA:

Our analysis shows that many projects are lagging behind announced schedules. Challenges in securing off-take agreements, financing, and government support will lead to substantial delays in the start of operations. A comparison of the total project capacity based on commercial operation dates (CODs) announced by developers versus CODs estimated by GENA shows a substantial gap between them for 2025-2029.

Clearly, it is a very long way to scaling for the volumes needed for global shipping, and cleaner methanol production for everyday products without fossil fuels.

Renewable methanol production facilities are being developed in many locations - for example, a commercial-scale plant producing bio-methanol from bio-gas is in operation in the Netherlands, Denmark, Canada, etc. In Iceland, e-methanol is produced by combining renewable hydrogen and CO2 from a geothermal power plant.

China, of course, leads the way, with an estimated 45 plants in development for potentially 8.7MT production by 2028.

In the case of methanol, we must consider that its specific volumetric energy density (LHV) is 4.38 kWh/L and it is >50% less compared to diesel, 10kWh/L or marine gas oil, 10.2 kWh/L.

In our comparison, the same ship needs to carry twice as much fuel for the same energy input:

It is clear that even if we used all the globally produced methanol to power a ship, it would only last about 3 months.

We would need more than 400 Mt of biomethanol to cover the annual fuel consumption of maritime by green fuel.

Summary

We have two future fuels for decarbonising maritime shipping under consideration here, and it looks like Methanol is the most favoured going forward.

Neither option is an easy solution, while scaling production to meet global demand is an incredibly vast and time-consuming process.

In the interim period of the maritime transition, ship owners and operators will be looking for every marginal gain in efficiency and optimisation to reduce the impact of the IMO emission regulations costs.

Decarbonisation of the shipping industry is relatively high-hanging fruit reachable only using a very long ladder! 🍒

What else can we do in the meantime ⁉️

There are approximately 200 mil. SUVs in operation, which with internal combustion engines, consume 500-600 Mt of fuel annually. 🤯

And we should not forget that a huge proportion of global maritime shipping is transporting fossil fuels.

In 2023, the total freight transported by the shipping industry reached approximately 12.3 billion tons, of which:

⚫ 2 billion tons of oil

⚫ 1.5 billion tons of coal

⚫ 0.4 billion tons of Liquefied Natural Gas

⚫ Total of 32% of the total maritime shipping

The decisions and strategies we make everyday across the whole energy transition are all connected to the fossil fuel industry and our fossil fuel based economy.

Sometimes, quicker pragmatic solutions can help us on the journey and reduce the scale of the ultimate goal. ⚡

About the Author

Michael Sura

Michael is an energy and transport analyst, strategist, and advisor based in Slovakia 🇸🇰