The Valley[s] of Death?

The infamous Valley of Death curve for climate tech startups - how many are there anyway?

The world of climate tech is a challenging one. Developing large-scale industrial processes, technologies, or grid-scale solutions is fraught with significant technology and investment risks.

Many make it through some early challenges - initial technology prototyping, grant funding, team development and establishing indicative product or solution-market fit.

But as time moves on, and the technology roadmap leads in hope towards partnerships through pilot projects and into potential commercialisation, the 'valley of death' curve looms large. 😱

It's a familiar term and challenge that keeps startups and early-stage investors awake at night!

A reminder of the widely established definition, this time from Investopedia;

"A startup company's Death Valley curve is the span of time from the moment it receives its initial capital contribution until it finally begins generating revenue. During this window, it can be difficult for firms to raise additional financing since their business model has not yet been proven. As its name implies, the Death Valley curve is a challenging period for startup companies marked by a heightened risk of failure.

Nothing new here, there are a whole host of reasons why and when this occurs. Is it a function of timing and transition between the available non-dilutive to equity-based investment vehicles? Or is it a lack of planning, strategy and timing of startups? Well, as ever, it's likely a bit of both.

SaaS startups

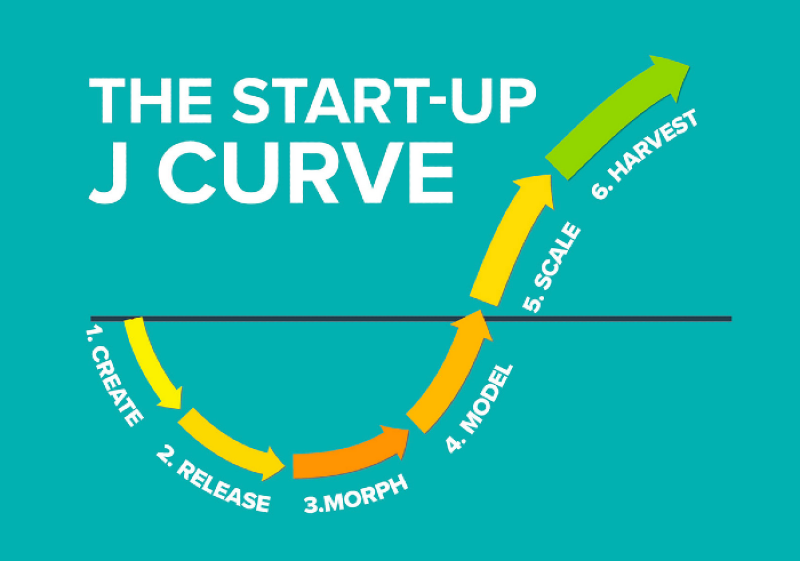

With a SaaS startup, there is only one perceived valley - as the startup tests and develops the Minimum Viable Product to find product-market fit; once they hit the sweet spot, they can be up and away on the J-curve growth track.

If well planned and managed, monthly cash burn can be relatively light. The MVP and initial market user base can quickly provide feedback for product iteration and adaption. Fail fast and learn quickly is the order of the day. Get the mixture of early traction and revenue models right, and you're in for the win. 🙌

This is why software startups are nearly always more compelling investments for VCs looking for quick growth and returns. 🏖️🍹

Popularised by Howard Love in his book, 'The Start-up J Curve, ' the six phases of a venture in principle.

Some background reading on that from Regions' Alliances for Interconnected Startup Ecosystems, RAISE

Hardtech + Deeptech startups

This is where it gets more complex and the key challenges in climate tech lie. Software and Hardware are inexorably linked like Romeo+Juliet in today's digital world - they simply can't survive without each other, and in climate tech terms, we can't do it all with software. Hands need to get dirty.

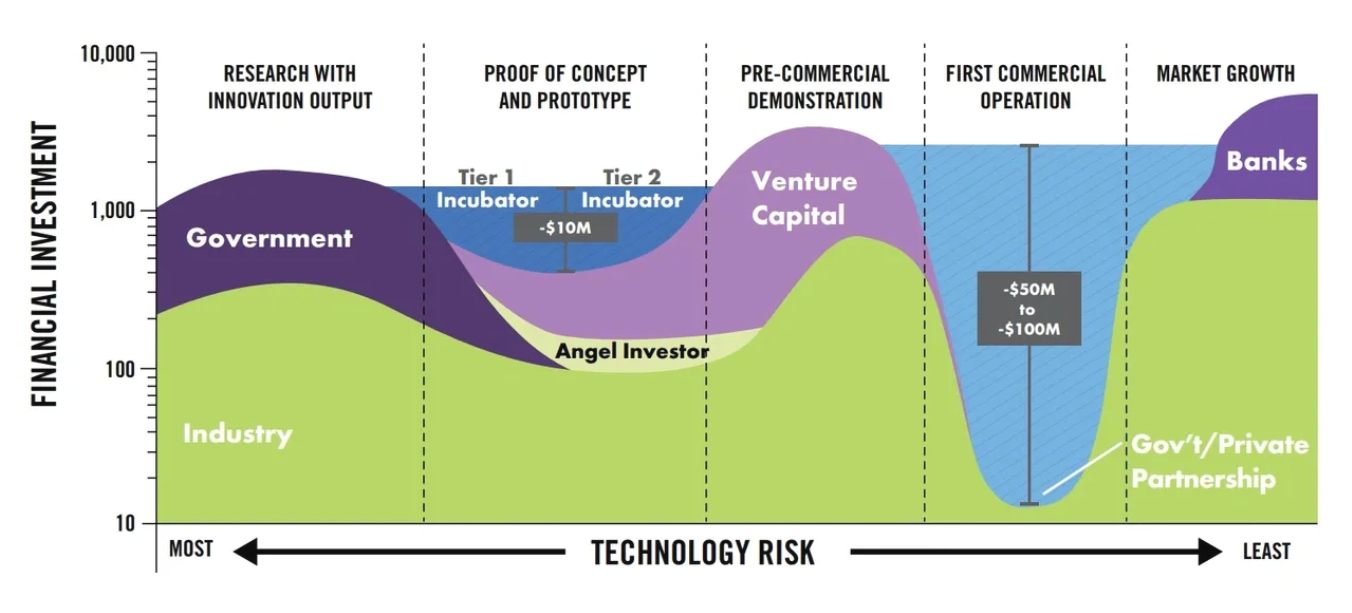

We aren't going to dive into the complexity of each stakeholder element in this post, perhaps another time. But as you can see from the nice infographic below from the Maryland Energy Innovation Accelerator, complex hardware innovation potentially offers two valley of death hurdles;

- Valley #1 - The transition point at Proof of Concept [PoC] and prototype stage where non-dillutive funding from Government may run out. Startups hope that angel investors might be willing to dip in, and possibly some early-stage and patient VC. But if VC can't see a path to profibility, or there are doubts about the technology, market-fit, regulation, founders etc. then this may be a bridge to far.

- Valley #2 - Just when you think you might be home and dry and commercialisation is on the table, you hit the big one. You need capital to create and scale the operation, materials, facilities, supply chain, team, and the list goes on. You may have off-take agreements, partnerships or other potential market traction and revenue tangibles, but unless you have patient capital to bridge the gap in the interim... 🏳️

Two Valleys of Death then?

Possibly, or possibly more - the question is, just how many Valley's of Death are there?

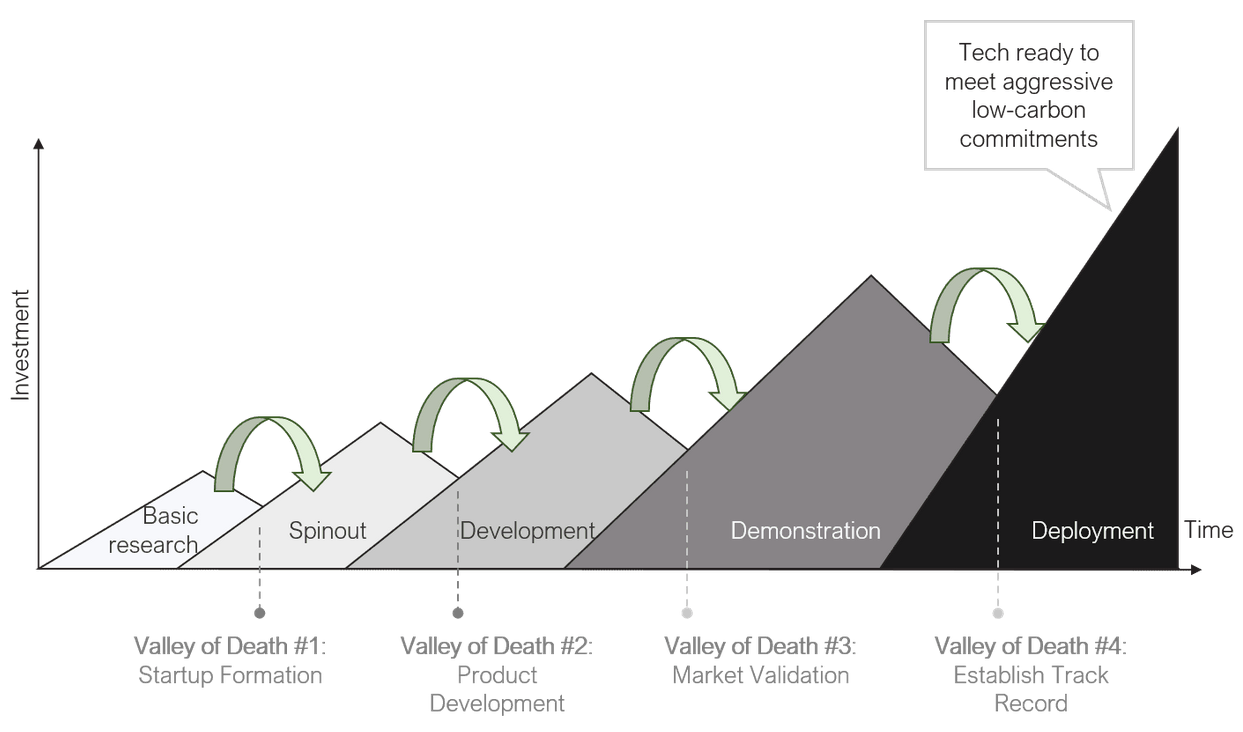

I came across an article from Wang & Yee on Third Derivative which suggested there maybe FOUR Valleys of Death when it comes to the complexity of climate tech. ☠️

I know, as if it wasn't hard enough already. No wonder the world is strewn with the wreckage of climate tech startups. 💥

Disappointingly, they chose not to colour their infographic - the climate tech journey is anything but greyscale - let's dive on in!

#1 - Startup Formation

The article has a leaning to University startup spinouts, or lack of them, and the complications of technology transfer. Couple this with the challenge of PhD or Post-Docs running projects without the necessary commercial experience or skillset, and you have your first major valley.

# 1 - Additional Factors

These are significant challenges. Additionally, I would add to this the high cost of spinout equity typically taken by Universities, which can be between 20-30%. Quite the burden on the cap table for future equity investment.

We should also consider that not all startups are University spinouts, certainly from my experience over the last couple of years. That brings other challenges, including but not limited to;

- Facilities - no free lunch for PoC development ⚙️

- Founders - coming together it could go either way, like magnets 🧲

- Non-dillutive Funding - a very competitive grant landscape 💸

- Legal & commercial - set-up and structure 📝

- Visibility - being seen and heard, yes, you have to do some marketing 🔊

You're off to a great start, no bother 😄

#2 - Product Development

Product-market fit and launching an MVP to market are key challenges for climate tech startups. The SaaS playbook long went out the window. The market is complex - regulators, incumbent corporates, manufacturing, supply chain, and integrated systems. All significant hurdles for startup founder teams.

#2 - Additional Factors

The climate technology roadmap can be complex and problematic at this stage. Without the time and cost flexibility for SaaS agile development, some hard commitments have to be made.

- Modular design - flexibility may not always be possible ↪️

- Design variations - potentially limited scope of change 💡

- Testing & validation - time/cost of data acquisition and approvals ✅

- Market alignment - in a fast moving market, you could be D.O.A ⌛

Halfway then, no one said it was going to be easy 😅

#3 - Market Validation

The first full-scale commercial solution and facility to deliver it. There's a reference here to 'death by pilots' - the challenge of breaking into incumbent market players and positions and general sector inertia. The misfiring and struggles of corporate venture activity also sit here.

#3 - Additional Factors

Depending on your take, I think 3 and 4 in this model split the 'original' principle Valley of Death. First Of A Kind, [FOAK] projects and finance have a broad definition, depending on who you ask, the project and technology.

Definitions aside, this cross-over point brings many obstacles to hoisting yourself up and out of the valley;

- Stakeholders - Gov, partners, angel, VC, corporate, developers ‼️

- Team - more people, skills, relationships - big challenges all round 🤼

- Finance - costs are up, runway is at risk, time is the enemy 💰

- Policy - planned support may change on route 🪄

- Business model - does the model still work, can it adapt ⁉️

Almost there, aren't you? 😓

#4 - Establish Track Record

Scaling up, market adoption and the capital challenge. This undoubtedly requires debt and infrastructure capital. Which demands more stable cash flows with technology risk effectively removed.

The challenges here are nuanced for all markets and technologies, but the cliff face of this valley always looks the same. It's the big one!

#4 - Additional Factors

This is a whole other subject - from FOAK into NOAK [N'th] and Project Finance and all the sub-sections of those complex mechanisms. Not for today, but some key considerations;

- Risk - underwriters, insurance and investor risk management 🚫

- Agreements - off-takes, PPAs, feedstocks, production volumes 🤝

- Partners - the right skills, experience and teams to deliver 👥

- Complexity - it's simply a massive undertaking 🚀 🌍

You made it! Or did you? 😭

90% + of climate tech startups don't. The reasons and exact percentages for failure are variable by technology, sector, investment stage plus a host of other factors.

What is clear, it is incredibly hard to scale a startup to full commercialisation.

Bridging solutions

Well thats a work in progress for climate tech. There are a lot of people, organisations, institutions, Gov. agencies, NFP and investors all trying to build those bridges as quickly and as strongly as possible.

What are some of the mechanisms currently in play? A mixed bag cobbled together with the best intent. But we need a more cohesive and holistic approach.

This is where key climate tech sector stakeholders need to enhance collaboration and knowledge to drive change, as we move into a crucial period on our decarbonisation journey;

- More accessible non-dillutive grant and debt financing

- Strong market advance purchase and offtake agreements

- Strategic partnerships in markets, supply chain and corporate venture

- Investment share upside to incentivise early market adopters

- New and innovative business models

- New ecosystem and stakeholder owner/operator/support structures

How many Valleys then!?

You might have reached your own conclusions by now - is it the traditional 1, 2, 4, or perhaps even more?

Are they really Valleys, or has the definition and scope been extended beyond its original intent? Are they just the encumbent complex challenges of climate tech startups?

Me, I think at least 4, probably 5, is the right number. 🤔

Kane 🌱