Offshore Wind Support Schemes - Challenging Headwinds - Part 1

How have past support schemes performed, what does the current system offer, and is there a better way forward...

Introduction

This is Part 1 of 2. In this article, we are going to explore the schemes implemented to support low-carbon renewable generation in the UK over the last 35 years.

It feels like a relevant moment to take a retrospective of where we have come from, if the current support scheme is effective, and what key learnings we can onboard. Clean Power 2030 and our ultimate 2050 targets loom large on the horizon - we simply have to deliver, for many reasons.

To meet our objectives, we must ensure the right market support mechanisms are in place. As we will explore, despite the great progress the UK has made in offshore wind, there have been failures, missed opportunities and challenges for all stakeholder groups under the historical and existing market support schemes.

Virtual Resource Model

To address the key issues raised in this Part 1 article and foster the greatest roll-out of low-carbon generation for the future, in Part 2, we will introduce an alternative mechanism - a Virtual Resource Model. It allows for a defined support volume, lower risk, direct open access to the market, and competition to ensure the lowest cost.

The mechanism is based on an economic structure that attributes socialised value to the resource. This provides an efficient mechanism that stimulates the market, enabling it to be efficient through minimal intervention, while maintaining competition.

To assess what could be the most effective mechanism for the future, we have to appreciate the history and context of what has gone before.

Historical Support Context

Commercial-scale low-carbon generation has been financially supported through various schemes within the UK since 1990, including:

▶️ Non-Fossil Fuel Obligation (NFFO)

▶️ Renewable Obligation Certificate (ROC)

▶️ Feed-in-Tariff Contract-for-Difference (CfD).

Ultimately, none of the support schemes has had the desired effect of facilitating sufficient growth in low-carbon generation to meet government targets, creating a comprehensive local supply chain, or keeping consumer costs to a minimum.

While the CfD may be viewed to have facilitated large-scale delivery and cost reduction, this likely doesn't reveal the full picture. A more comprehensive assessment is required, which doesn't suffer from omitted variable bias and a lack of a full system cost analysis.

Non-Fossil Fuel Obligation (NFFO)

The NFFO was set out in the 1989 Electricity Act to support renewable energy, as market prices were not high enough to provide a viable financial return for renewable energy projects. It was a first-price, sealed-bid, auction-based system that required bidders to submit their lowest bid to secure a fixed price for electricity generated over 15 years.

Effectively, it was an auction-based Feed-In-Tariff with no time-based pricing signal. It was financed through a levy on fossil fuel generated electricity (the Non-Fossil Fuel Levy), which was paid by consumers. Renewable energy generation was provided a Levy Exemption Certificate, and so benefited from not incurring the additional cost.

The process was a mid-development auction for projects that met the prerequisite criteria to enter the auction, e.g. development consent and grid availability. It had inherent flaws that increased system risk and cost, while depressing profits in the sector, in favour of limiting cost to consumers. This ultimately disincentivised investment in low-carbon generation technologies.

The interventionist process limited market visibility and a smooth transition from development to construction, while the complexity of the process excluded micro-generators from support.

During the period of the NFFO, the UK’s supply chain failed to grow and keep pace with the supply chains of other nations that used simpler policy structures, which allowed access to all potential market participants. For example, Feed-In-Tariffs in Europe enabled the growth of domestic turbine manufacturers;

🇩🇰 Denmark - Vestas

🇩🇪 Germany - Bonus (later Siemens), REpower Systems (later Senvion)

🇪🇸 Spain - Gamesa (later Siemens Gamesa)

🇫🇷 France - Multibrid (later Areva)

The NFFO’s complex structure required significant amounts of administration, preventing domestic customers and micro-developers from taking part in the market. It also placed excessive pressure on developers to maintain access to the market. A developer that was unsuccessful in securing an NFFO couldn’t progress their project; the sunk costs would either have to be written off or would remain on the project’s books, further weighing down any subsequent business case and future NFFO bid.

The auction bidding process meant that developers were pitched against other developers. Those who were responsibly developing their projects and calculating their minimum cost had the risk of bidding against developers who may not have been as diligent about their cost base, or who might be reckless in cutting bid prices to maintain market access.

Because of this excessive pressure, developers’ bids in the auction process may well have been pushed to below the price required to build the project. As demonstrated in Auction Round 4, projects that won were cancelled, and non-delivery became a problem. AR5 was the last order under the scheme; it was replaced by Renewable Obligation Certificates.

Renewable Obligation Certificate (ROC)

The ROC was introduced to replace the NFFO when it was clear that the NFFO was failing. It mandated a percentage of electricity that suppliers were obligated to supply from renewable sources. Renewable generators were issued a certificate for each MWh generated that was then traded to suppliers to meet that obligation. If suppliers failed to provide sufficient ROCs to meet their obligation, they could pay a buy-out price.

The buy-out price effectively capped the value of the renewable electricity generated, and so limited the profitability of renewable generation, disincentivising investment. The industry also identified another theoretical problem with the mechanism - an oversupply of certificates compared to those obligated, which meant the traded value of the certificate could drop to zero. The cliff-edge problem.

To get around this theoretical problem (at no point was the renewable supply obligation ever exceeded), the government implemented headroom; an assurance that the obligation would always exceed supply by 10%. This effectively made the ROC a complex Feed-In-Tariff, again with no time-based pricing signal.

Lobbying by industry led to variable levels of ROC across technologies;

💨 Offshore Wind went from 1 to 1.5, then to 2, ROCs per MWh

🌊 Wave and Tidal Stream at 2 and 3 ROCs

🌊 Wave generation in Scotland negotiated up to 5 ROCs

The process was complex, which excluded smaller projects from taking part in the market. Therefore, it didn’t provide competition to lower costs, while it also limited potential profitability. This left the government effectively imposing an unlimited levy on consumers to cover the costs of the mechanism. The ROC was also restricted to renewable electricity and so excluded nuclear.

To facilitate new nuclear build, the government subsequently introduced the Feed-In-Tariff Contract-For-Difference.

Current Support Context

The following appraisal of the CfD might be considered controversial; during the time that the CfD has been in place, Strike Prices (government-guaranteed price per MWh) have decreased significantly, in parallel with a notable increase in deployment of offshore wind.

The prevailing opinion is that the CfD has been a significant success. However, consideration should be given to further argument - cost reduction and capacity growth have been a natural result of the stage of the industry. The offshore wind industry started in the UK in 1990, and the CfD has been in place since 2014. The 24 years of development leading up to the CfD, have meant that capacity was naturally going to grow, and in turn, prices would reduce.

Had a more effective alternative policy been in place, the industry may have grown faster, been more innovative, and had an even lower cost.

Feed-in-Tariff Contract-for-Difference (CfD)

The CfD is an auction-based system that sets a fixed Strike Price for generation that either makes payments to generators or requires payments from them, depending on the Strike Price relative to the market prices.

If the market price is below the Strike Price, the developer is paid the difference; if the Strike Price is above the market price, the developer pays the difference.

These payments are made via the Low Carbon Contracts Company, which is funded through a levy on electricity supply companies, the Supplier Obligation. The Strike Price a project gets is set through Allocation Rounds, with 6 having been held so far. Projects within the same “pot” clear at the highest price of a winning project, setting the Strike Price for all the generation in that pot, so effectively it is a second price reverse auction.

To bid in an Allocation Round, projects have to bid a price below the Administrative Strike Price, the maximum price the government is willing to let a technology secure a contract within the process; AR5 secured no offshore wind bids as the ASP was set below the price the market believed it could economically build for.

Alongside the CfD, the government implemented a Supply Chain Plan process to try to ensure the development of the supply chain, local content, innovation, etc. The SCP process is a pre-validation of projects (upon approval of their SCPs by the government) to allow them to enter into the Allocation Round. National Grid acts as the body arbitrating the allocation.

The cost of the scheme is paid for through a levy on energy suppliers, the Supplier Obligation. Modelling of the expected costs (through evaluating the ASP against the market price) by the government sets the expected volume of generation to be contracted.

The Allocation Round bidding process seeks to commission the maximum amount of generation against that budgeted support, should their market forecasts prove correct.

All Risk and No Reward

However, the mechanism suffers from a confluence of risks. If market prices go above those modelled (and certainly if they go above the Strike Price), then the cost of the dispatched generation is lower than the Allocated Round originally budgeted for.

At that point, there will be lower deployment of low-cost offshore wind because the forecast was inaccurate.

The key outcome is that consumers have ultimately been exposed to higher power prices.

The additional impacts are significant; less renewable generation means carbon reduction efforts are impeded, and supply chain development is held back - costs are subsequently kept artificially high as a consequence.

However, if market prices are below those modelled, the levy would be above that predicted. This effectively creates additional taxation on power consumers, above the intended. The levy control framework is set by Treasury, who recognise it as a tax.

This confluence of risk is due to the centralised decision making and attempt to model the market, something that is widely regarded to be unfeasible.

In post-completion analysis, even the modelled costs of the scheme after the allocation rounds have proven to be wildly out:

Pot 2 in AR1

📈 Budgeted cost (to 2021) £1,095m

➡️ Post allocation round - expected cost £532m

📉 Actual cost; only £293m

Pot 2 in AR2

📈 Budgeted cost (to 2023); £580m

➡️ Post allocation round; expected cost £192m

📉 Actual costs; -£144m!

While it could be argued that at the time of AR2, the price fluctuations due to the Russian invasion of Ukraine were not known, the point is that the system is sensitive to forecast error, and markets are inherently unforecastable!

Fundamental Flaws

It is clear that the CfD system is not only failing to provide the budgeted financial support to the low-carbon generation industry, but is reducing profit throughout the market - contrary to its objective of making the industry an attractive one to invest in.

The idea behind the CfD was to provide a fixed price per MWh for power to reduce revenue risk and facilitate a low cost of capital. Specifically adopted to accommodate nuclear generation - where a plant’s operational life is 60 years - a guaranteed price of electricity is desirable. Here, the CfD provides a fixed price for 45 years.

For renewable energy projects - where the operational life may be 25 years - the first 15 years secure a fixed price through the CfD. However, renewable energy projects often enter into a Power Purchase Agreement (providing developers with a fixed price) to secure project debt. On this basis, arguably, the CfD did nothing to lower the cost of capital; even if developers don’t enter into PPAs, markets are excellent in offering hedging services for such risk.

Further, if a project does enter into a PPA, the CfD introduces a PPA/Market price risk. As an example, in recent years, power prices have been high enough that

payments have been consistently made to the LCCC, e.g. AR2 projects have returned £118m.

This includes the period when the Interim Levy Rate set for the Supplier Obligation was set to £0 as the LCCC had a surplus, which was subsequently used to subsidise fossil generation through the Energy Bills Support Scheme.

If a project is not trading its power in the markets, the difference between the market price and the PPA price, if not hedged, would be a loss, as traded volumes in the reference markets have not substantially changed since 2012 - it would seem that the CfD contracted power is not being traded. At the same time, the ability to enter into a PPA means the actual LCoE of projects is not visible through the Strike Price bids.

Repeating Past Mistakes

In addition to the price risk, the CfD, with its auction-based process, replicates the same flaws as the NFFO. Developers require access to the market, and to secure that, they have to win a CfD. Failure to secure a CfD means significant delay and cost for a project, additional cost of development, while bearing the sunk cost at the cost of capital, for a greater period.

While managing this additional cost, the project has to drive its LCoE even lower to be able to submit a potentially future winning Strike Price in the next Allocation Round.

All of this means developers have unreasonable pressure on them to underbid.

The uncertain nature of whether a project will secure a CfD means developers are strategically driven to lower upfront development costs. That upfront cost saving means the project doesn’t have sufficient resources to develop the project effectively, e.g. understand the full scope of engineering and costs.

Similarly, the supply chain also optimises the upfront expenditure on projects. While a project does not have a CfD, the supply chain has limited interest in putting resources into providing budgetary information, as they dedicate resources to a “get/go” contract calculation basis;

Any resource put into upfront pricing estimates, needs to pay back against potential profit against the get/go metric. However, with the CfD there is a “get/get/go” calculation;

Yet the project still has to set its Strike Price; therefore the pressure on developers to maintain market access, combined with the pressure on them and the supply chain to minimise at-risk cost, leads to very low Strike Price bids and risk of non-delivery.

This was reflected in AR4, where two of the five offshore wind projects did not progress to Financial Investment Decision. While that example focuses on offshore wind, and the CfD applies to all renewable generation types, the reality is that in AR4 offshore wind accounted for 64% of the total contracted generation capacity and 23% (37% of the offshore wind) wasn't delivered.

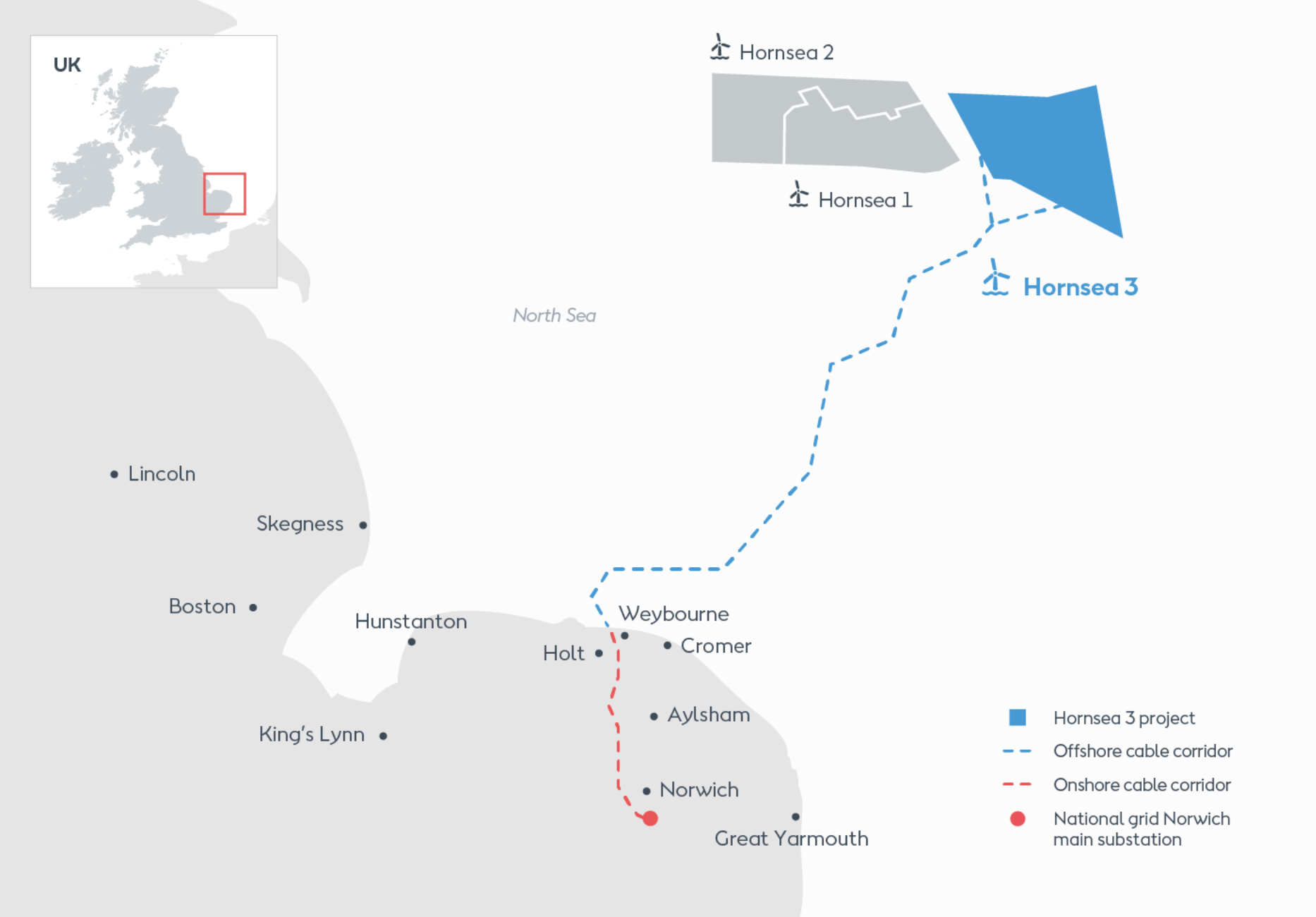

The projects that had difficulties included; Norfolk Boreas developer Vattenfall 🇸🇪, which declared that it will not progress into construction and was subsequently sold to rival RWE 🇩🇪, and Hornsea 3 developer, Orsted 🇩🇰. These projects won their CfDs at the expense of losing bidders, such as Seagreen 1A.

The real problem, beyond the non-delivery of the renewable generation - losing bidders have been excluded from the market by their competitors, who have bid in at a price too low to build.

The winners may argue failure to make CfD is because of greater than expected market-specific inflation - the CfD payments are inflation-linked. The fact remains, losing bidders have incurred significant additional cost and delay by not winning the CfD, even though they may have had more conservative market specific inflation estimates.

Supply Chain Challenges

The CfD limits supply chain visibility of what projects are going to go into construction, and on what timeline. This leads to a lack of early engagement from the supply chain due to the significant uncertainty about their ability to progress to construction.

A further impact is the limited planning capability for supply chain’s order book, with only 18 months for projects to move from CfD award to entering major contracts, effectively a FID. With a typical offshore wind construction programme of 3 years, suppliers are only able to plan their manufacturing schedules for relatively short periods while managing significant risk and uncertainty.

This leads to an inability to understand the demand within the market, plan manufacturing, and invest in increasing manufacturing capacity.

The imbalance between demand and supply, can lead to sector-specific inflation. To compound these challenges, CfD also acts as a barrier to innovation and new entrants to the supply chain. The developers’ need to minimise upfront spend, and understand cost at an early stage for their Strike Price bid, means that major innovation and new suppliers have an extremely hard time engaging and entering the market.

When considering nacent industry innovation, such as Floating Offshore Wind, this becomes an even greater barrier to entry. In AR6, Green Volt, a 400 MW project being developed by a consortium between Flotation Energy and Vårgrønn, was the only floating project that was successful.

Developers are focused on keeping their resources working on the most relevant, lowest commercial risk suppliers, and securing the best possible prices from them; the technical and price validity of the innovation is secondary. Once they have secured a CfD, they need to progress to construction as quickly as possible with an existing, derisked supply chain.

The risk of a supplier not being able to supply, or the distraction of having major technology innovation as an element of project, is too great a risk and resource drain to make economic sense.

Supply Chain Profits Diminishing

The reverse price auction process sets the dispatched generation price at the lowest possible economically viable level, for the required return of the developer. This is based on their best forecast of the lowest possible capital expenditure. The impact; profit within the sector is driven to the lowest possible, further impacting supply chain profitability.

The unintended consequence for government - investment in the supply chain becomes unattractive when we are seeking expansion and growth. Despite the SCP process, the cumulative impact has limited industry growth in supply chain capacity, despite significant ambition for increased generation.

Grid Implications

We should also consider that the CfD process has wider impacts on the grid connection process due to its de-linking generation from demand. Projects get their Strike Price as long as prices remain only just positive and feed into what is most likely an already congested grid. The race to decarbonise the electricity system has led to a huge volume of projects in development; however, to get access to the market, they all have to have a grid connection. The current grid connection process requires National Grid to model what upgrades are required for those projects, and then make a connection date offer.

However, despite the recent reforms, the uncertainty of project delivery makes it almost impossible for NG to model which projects may be in operation, and so what upgrades may be required; whether a project will secure a CfD, and then actually progress to construction (as Norfolk Boreas and Hornsea 3 have not), is unforeseeable.

As a final note, the CfD process effectively requires participants to be large and sophisticated enough to partake in the day-ahead intermittent traded power market, so it excludes smaller developers. i.e. any developer who looks to sell their power through a PPA.

What's Next?

That is a good question! The opportunity to revist the support schemes of the past, and the incumbent CfD - which at the time of writing has just had an update in advance of AR7 - is important for context in advance of any proposed alternatives.

In Part 2 we will explore in more detail the Virtual Resource Model, its scope, benefits and advantages over the CfD.

About the Author

Matt Bleasdale

A consultant to the Offshore Wind sector, Matt has a weath of experience from a career begining in subsea and later with project and contract management with E.ON, London Array and The Crown Estate. His own consulting activities have led him to work with organisation such as Orsted, Bureau Veritas, and Iberdrola.

You can follow Matt on LinkedIn:

Matt Bleasdale - Offshore Wind Consultant