Maritime UK Solent - Coastal Powerhouse Summit 2025 Event - Part 1

Decarbonisation and Innovation at the core of the inaugural Maritime UK Conference for the Solent Region

Fantastic to have the conference located at the heart of the Solent Maritime cluster in Southampton, bringing together stakeholders - commercial, infrastructure, academia, naval, policymakers and innovators - through 400 delegates and 35 speakers across various topics.

Also, it saves me from having to travel up to London for a change 🙄

Cruise, Sir?

Always interesting to visit Southampton Docks and go beyond the security gates, this time onwards into the Ocean Terminal building in the cruise port. Not somewhere you ordinarily get to visit in the city as a resident, unless you happen to be of a certain age and shipping out for a cruise.

Just across the dock from the National Oceanography Centre - more to come from there soon - stay tuned...

Economic Context

The Marine sector is indeed a 'powerhouse', not only for the South Coast region, but it is of vital national strategic importance and economic contribution.

Some numbers for the Maritime UK Solent region specifically:

📈£10.3bn v £7.9bn GVA to UK economy [2023 v 2019]

📈£6.5bn indirect & induced GVA

📈£3.8bn direct v £3.1bn direct GVA [2023 v 2019]

🙌138,000 v 130,000 employed [2023 v 2019]

⚖️ 95% of UK global trade by weight

In the wider context of the UK the Maritime sector;

£116bn total turnover and 1.1million jobs, and is larger than Aviation and Rail combined.

Chris Shirling-Rooke, Chief Executive, Maritime UK [2019 data]

Decarbonisation Strategy

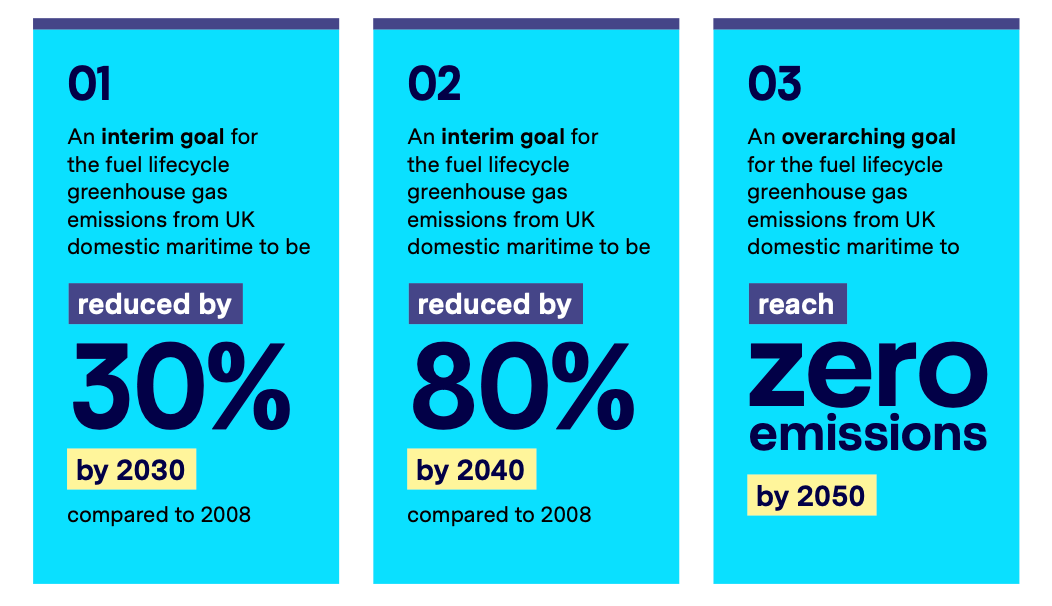

Maritime decarbonisation was top of the agenda, coordinated with the launch of the UK Government's Maritime Decarbonisation Strategy to 2050.

If you want to dive into those 95 glossy pages, here you go. The document dovetails with Westminster's key missions and guiding principles, specifically here, making the UK a clean-energy superpower and kickstarting economic growth.

The challenge is significant and the ambition strong across the next 25 years - UK domestic maritime produced an estimated 8MtCO2e in 2019 [well-to-wake];

A Keynote to launch the policy was delivered by MP Mike Kane, Minister for Aviation, Maritime and Security, with the adoption of the UK Emissions Trading Scheme (UK ETS) and alignment with the wider IMO 2023 GHG Strategy and April's E-Fuels strategy.

E-Fuel Merry-go-round

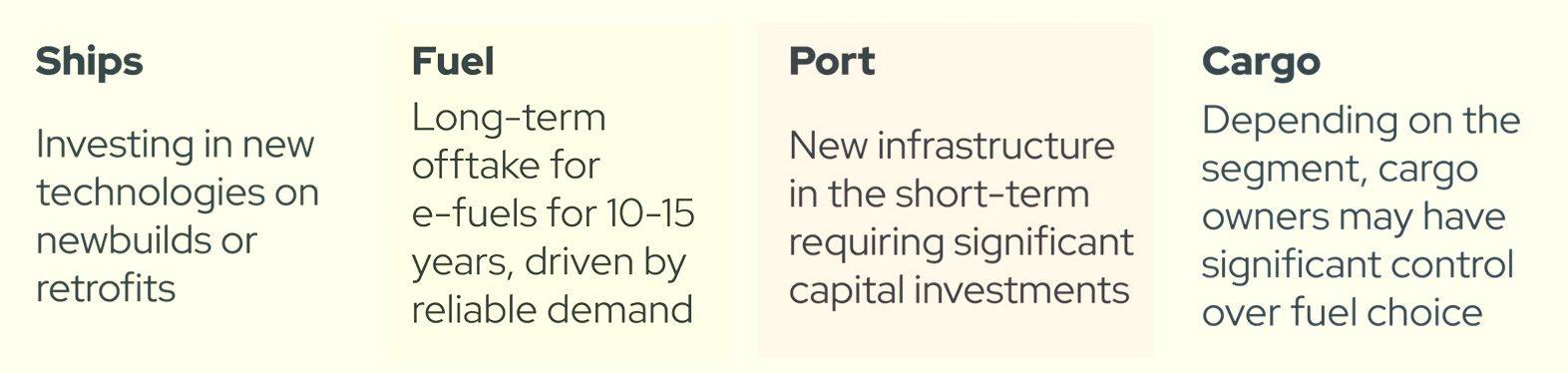

Interesting summary of that wider sector context here from Global Maritime Forum. E-fuels are the long-term decarbonisation play for large tankers, container fleets and cruise ships, and require significant global scaling through to 2025 to meet demand - key drivers:

The DNV Alternative Fuel Insights Platform 2024 data, indicates LNG as the current favourite, at least in the short-medium term, due to supply and bunkering infrastructure - 2024 new vessel orders:

The EU Fit-for-55 regulatory policy driver for a network of ports to provide LNG bunkering infrastructure, is likely facilitate LNG supply availability in the coming years as the 'bridge fuel' to future E-Fuels scale and availability.

It's out of the fire and into the frying pan on this one - a 'bridge' to nowhere better on emissions? 🔥

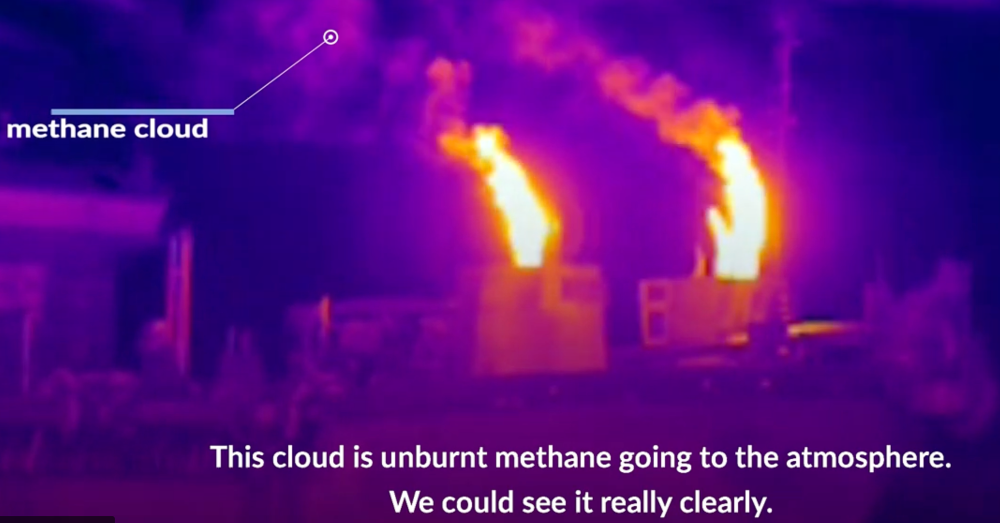

From existing fossil bunker fuel and into LNG, means methane - methane leaks throughout the supply chain, and methane slip from engine operations via the ships funnel.

Want to see that in action, have a look at this still from an infra-red video, click through to watch the full video:

The real kicker - methane has a much stronger global warming impact, some 80 times more than CO2 over 20 years, and by 2030 25% of EU ships are likely to be LNG. More on methane impact locally here from the BBC.

So...that's not great either - and standard methane slip regulations assume approx. 3%, when actually it's worse, more like 6% - more on that study here.

We will have more on Ammonia as a fuel source and the risks in Maritime shipping via an article from Guest Author, Michael Sura, coming soon.

Current state of play on comittments to new vessel procurement 🤔 not from the conference:

Market conditions, infrastructure development, fuel production updates, and cargo owners' needs are all shaping the demand for different fuels, both in the short and long term. The shifting trends in LNG and methanol orders this year might be due to the slow development of green methanol production. In the long run, green methanol has potential to be part of the energy mix along with ammonia. In parallel, LNG offers a vital bridging fuel option benefiting from existing infrastructure and short-term emissions reductions while being capable of acting as a long-term solution as well, assuming RNG (Renewable Natural Gas) will be available and provided at a competitive price.

Jason Stefanatos, Global Decarbonization Director at DNV

Essentially no one is entirely sure which horse to back. There wasn't much talk of Hydrogen, or Biofuels, other than the usual supply chain and volume challenges. Similarly, the panel concensus was...there is no consensus - the pending IMO relesase on Global Fuel Standards and Emissions Pricing in April, would inform further.

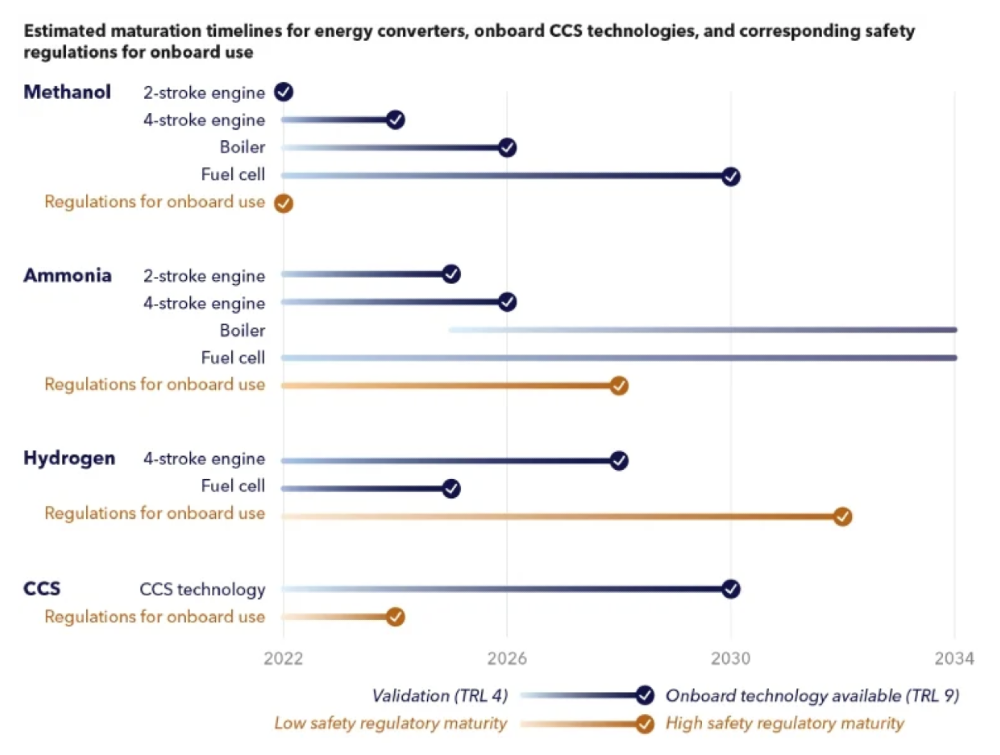

For context, a snapshot of Technology Readiness Levels [TRL] on future fuels, from DNV again:

E-Fuel Outcomes

There is simply no easy pathway to reduce emissions for trans-oceanic shipping in the transition period. At some future date it's more likely to be biofuels and batteries, and certainly batteries for short-haul. More on the fuel spectrum of the dizzying options here from Michael Barnard.

This multi-option pathway, of which essentially every pathway is a compromise of some sort, was reflected well in the panel discussion between panelists from Carnival UK, HMM, Sallaum Lines, and Tristan Smith of UCL Energy Institute, who has been involved with the technical development of the IMO standards.

Since this conference, with the IMO news released, an update from Tristan on the future of LNG via LinkedIn:

The agreement sets a clear limit on the viability of Liquefied Natural Gas (LNG) as a marine fuel solution. This pathway now faces basic penalty fees within the next few years, and will face rapidly growing penalty fees from 2033. It is not looking like a competitive choice for newbuilding (e.g. ships ordered from now onwards)

This transition period is clearly incredibly challenging for ship owner operators, covered in their commentary. Investment decisions on new vessels, which have to be procured in a relevant timeline, typically 3-5 years in advance, with due consideration on future E-Fuel global supply chains, pricing, infrastructure, port operations, safety, decarbonisation targets, emissions costs and future geopolitical scenarios - risky business indeed. 🎲 🎲

Onshore Power Supply and Emissions

As anticipated, some interesting panel discussions and commentary on Onshore Power Supply, and the inevitable challenges. A key local issue for the Solent's large ports with a mix of container, cruise, ferry and naval traffic in Southampton and Portsmouth.

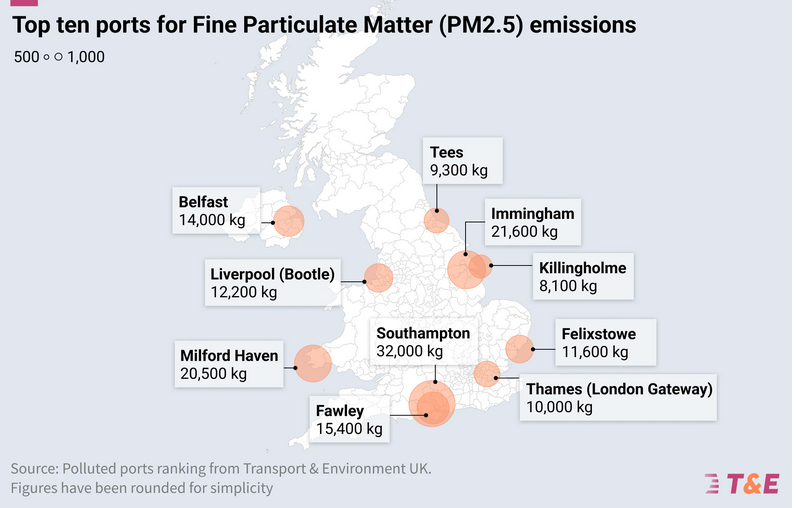

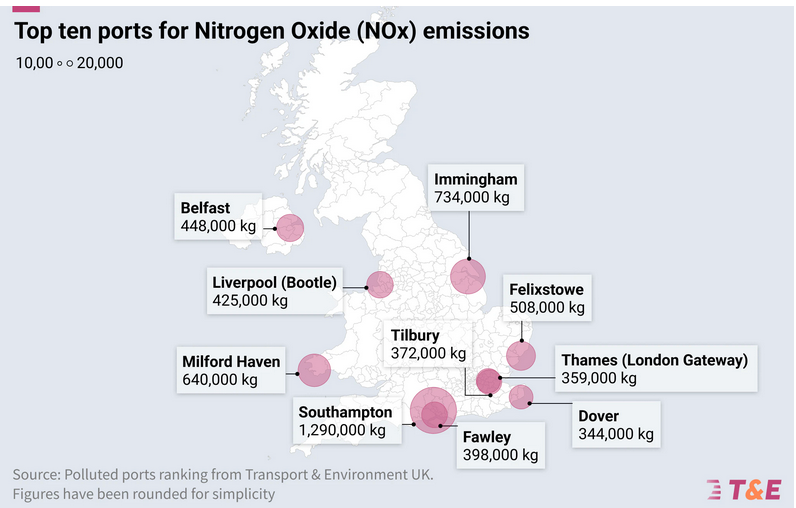

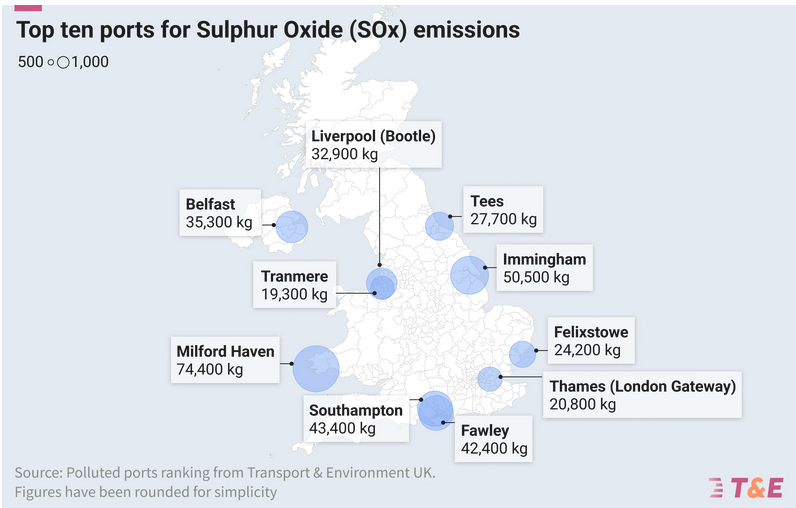

The data around in-port emissions is frightening - some excellent snapshots from Transport & Environment:

Southampton City gets the added bonus of being opposite to Fawley Oil Refinery Terminal to supplement its existing port emissions. As you can see decarbonising in-port via OPS is critical for health and emissions reduction:

In Southampton, 46 cruise ships - just 6% of vessels calling there - produced more SOx than 200 containerships, and over 50% of NOx and PM2.5 emissions.

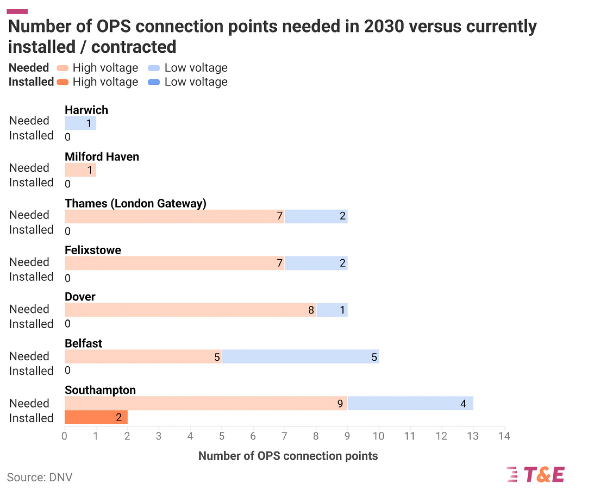

Positive steps then from ABP in Southampton, having installed two OPS that went live in 2022. ✅

Glad to see the hosts and sponsors having gone in relatively early, by UK standards, on grid connection [see chart below]. Which is great, but...

To Connect or Not Connect...

The biggest challenge being, if ships don't actually plug into it, it doesn't help. Some interesting data from Open Democracy here, widely reported on the BBC. ⚡

Solent LEP’s annual report suggest that the 55 ships that used shore power in Southampton in the 12 months to the end of March 2023 did so for an average of only 5.5 hours, spending the remaining 6 hours in port burning fossil fuel to generate power. A cruise ship consumes an average of 2,700 litres of diesel an hour in port.

This is where we get to the messy part of the energy transition. Grid congestion means only one of the two OPS connections can be used at any time. With UK power prices at record highs [since Ukraine], currently set by the marginal cost [gas generation], and no mandatory legislation to connect...it's cheaper for cruise ships to keep burning fuel in port. ⚫ 😔

And of course not all ships have OPS connectivity anyway. More on the first years analysis here from Lloyds Register.

This is where Gov. needs to accelerate change through policy and regulation dynamically - we lag behind Europe on this and Westminster simply isn't putting enough strategic vision, investment and impetus into OPS. ⏩

The UK is lagging behind the EU in forcing the cruise industry to reduce its emissions via shore power. Cruise ships visiting EU ports will be required to connect to shore power from 2030 under the FuelEU Maritime Regulation.

The Grid, Again

This frustration on policy and legislation was evident in a couple of the panels, running in parallel with restictions on grid enablement locally.

Wightlink, running the local Isle of Wight services from Portsmouth & Lymington are running a battery/fuel hybrid, and have explored full electrification of the smaller faster ferry services. The challenge always comes back to grid infrastructure. In this case investment of OPS on the IOW, and grid connections for OPS on the mainland are in the 2032-2037 date range. 🤯

I suspect the same or worse for Red Funnel on the Southampton hub. We can't decarbonise maritime ferry services and in-port emissions unless we get rapid grid upgrades. ⚡

It's a moving jigsaw, with pieces upside down for good measure - no one said the net zero transition was going to be easy!

Seachange

With all this grid frustration, there was some positive news on OPS. The Seachange programme in Portsmouth looks to be making good traction, bringing together innovation funding and multiple stakeholders:

SEA CHANGE is part of the Zero Emissions Vessels and Infrastructure competition (ZEVI), February 2023, funded by UK Government and delivered in partnership with Innovate UK. As part of ZEVI, the Department for Transport allocated over £80m to 10 flagship projects supported by 52 organisations from across the UK to deliver real world demonstration R&D projects in clean maritime solutions.

Sounds good, what's under the bulkhead?

Looks like OPS x3 berths for Brittany Ferries LNG/Battery Hybrids to plug into, fed from microgrid battery storage. Details are a little thin on the technicals relating to grid, renewables inputs etc, perhaps we can uncover more soon with help from some of ther key delivery partners as they move from demonstrator to full implementation.

The team includes University of Portsmouth [Emissions, Monitoring, Advisory] IOTICS [digital twin and data] Swanbarton [Microgrid] and B4T [Sensors].

Whats the forecast reduction impact:

Over 20,000 tonnes of CO2e per annum from 2027

Fantastic to see innovation funding and a multi-stakeholder project come together, let's hope this can be scaled up rapidly round other port infrastructure across the UK.

Whats in Part 2?

That was a run down on most things decarbonisation and future fuels. There are a couple more insights on Port Sustainability and Defence to bring you, plus the main scope of Part 2 is around innovation.

There were a number of startup pitch sessions as part of the ABP Energy Ventures Accelerator, supported and delivered by Plug and Play UK.

A run through on those next time around...